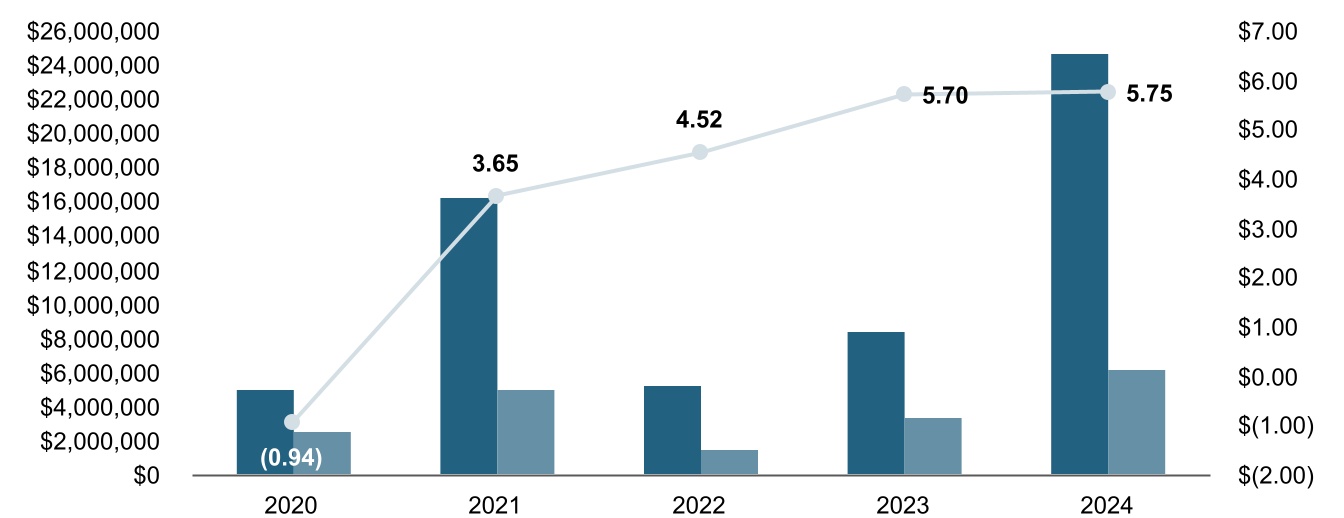

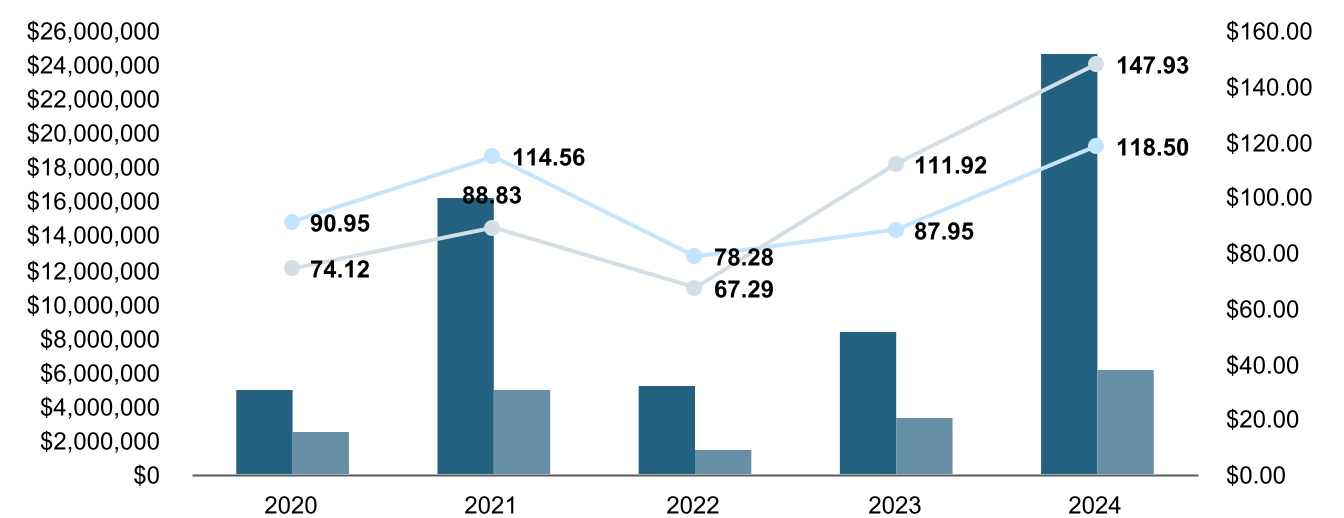

FALSE0001361658Travel & Leisure Co.DEF 14A226,243116,4561,138,870618,376iso4217:USDiso4217:USDxbrli:shares00013616582024-01-012024-12-3100013616582023-01-012023-12-3100013616582022-01-012022-12-3100013616582021-01-012021-12-3100013616582020-01-012020-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-310001361658ecd:PeoMember2024-01-012024-12-310001361658ecd:PeoMember2023-01-012023-12-310001361658ecd:PeoMember2022-01-012022-12-310001361658ecd:PeoMember2021-01-012021-12-310001361658ecd:PeoMember2020-01-012020-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:NonPeoNeoMember2024-01-012024-12-310001361658ecd:NonPeoNeoMember2023-01-012023-12-310001361658ecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:NonPeoNeoMember2020-01-012020-12-31000136165812024-01-012024-12-31000136165822024-01-012024-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMembertnl:NoahBrodskyMember2022-01-012022-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMembertnl:BradDettmerMember2020-01-012020-12-310001361658tnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMembertnl:NoahBrodskyMember2022-01-012022-12-310001361658tnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMemberecd:NonPeoNeoMembertnl:BradDettmerMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) | | | | | | | | |

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | |

| Travel + Leisure Co. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | | No fee required. |

| o | | Fee paid previously with preliminary materials. |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

2025 LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

We are pleased to present the Travel + Leisure Co. Proxy Statement and cordially invite you to our virtual 2025 Annual Meeting of Shareholders on May 21, 2025.

We delivered solid performance in 2024, showcasing our team's exceptional ability to execute at the highest level. Our core vacation ownership business fueled our growth during the year, led by an 8% increase in tours and volume per guest over $3,000. Our Travel and Membership segment also returned to Adjusted EBITDA growth, thanks to our disciplined approach and focused execution by the team. We capitalized on our momentum to expand our vacation ownership platform too, successfully advancing our multi-brand strategy. In the first quarter, we acquired Accor Vacation Club, and our integration efforts from a people, process, and performance perspective exceeded expectations. Additionally, we made progress on the planned launch of our Sports Illustrated vacation ownership club. We continued to invest in technology in 2024 as well, launching the Club Wyndham mobile app to great user reviews and making it easier than ever for our owners to search and book their next vacation. We are planning to build on this success with the launch of the WorldMark by Wyndham mobile app in 2025.

We remain focused on shareholder returns. We returned $377 million to shareholders through dividends and share repurchases in 2024, demonstrating the robust free cash flow generation capability of the business. As of year-end 2024, we had cumulatively returned over $2.5 billion of capital to shareholders through dividends and share repurchases since the spin-off of Wyndham Hotels & Resorts, Inc. in 2018. Your Board of Directors also recently increased our dividend by 12% to $0.56 per share for the dividend paid in the first quarter of 2025.

As we look to the future, we believe our resilient business model, strong consumer value proposition, expanding platform and favorable secular leisure travel trends will allow us to continue to deliver stable growth. This makes Travel + Leisure Co. an attractive choice for investors, consumers, and potential partners alike.

We owe our success to the hard work and dedication of our incredible team of associates. We are proud that our reputation as an excellent employer and a trustworthy company has been recognized by leading publications. We were honored to be ranked among the Best Companies to Work For by U.S. News & World Report, the Most Trustworthy Companies in America by Newsweek, and America’s Best Large Employers by Forbes.

The Board of Directors and executive team alongside our 19,000 associates around the world are focused on making strong progress across our business as we put the world on vacation and deliver results for our shareholders. We hope you share our pride with our 2024 performance and our excitement about the opportunities that lie ahead in 2025 and beyond.

Your vote on the matters detailed in this year’s Proxy Statement is very important and we ask for your support. Whether or not you plan to attend the virtual Annual Meeting of Shareholders, please cast your vote as soon as possible.

Sincerely,

| | | | | | | | | | | | | | |

| | | | |

STEPHEN P. HOLMES Non-Executive Chairman of the Board | | MICHAEL D. BROWN President and Chief Executive Officer |

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS

You are invited to participate in Travel + Leisure Co.'s 2025 annual meeting of shareholders. The accompanying proxy materials are being provided to you at the request of the Board of Directors of Travel + Leisure Co. (Board) to encourage eligible shareholders to vote their shares. References in this notice and the accompanying proxy statement to “we,” “us,” “our,” the “Company,” and “Travel + Leisure Co.” refer to Travel + Leisure Co. and its consolidated subsidiaries.

| | | | | | | | | | | | | | | | | |

| DATE AND TIME Wednesday, May 21, 2025 12:30 P.M. (Eastern Time) | | LOCATION www.virtualshareholdermeeting.com/TNL2025 | | RECORD DATE March 26, 2025 |

| | | | | | | | | | | | | | |

| Voting Matter | Board Vote

Recommendation | | Page |

| | | | |

| 1 | To elect nine Directors for a term expiring at the 2026 annual meeting of shareholders | FOR ALL of the director nominees | | |

| | | | |

| | | | |

| 2 | To vote on a non-binding, advisory basis to approve our executive compensation program | FOR | | |

| | | | |

| | | | |

| 3 | To vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2025 | FOR | | |

| | | | |

The matters specified for voting above are more fully described in the accompanying proxy statement. On or about April 11, 2025, we will begin mailing a Notice of Internet Availability of Proxy Materials to all shareholders of record as of March 26, 2025 and will post our proxy materials on the website referenced above and in the Notice.

Who Can Vote:

The record date for the meeting is March 26, 2025. This means that owners of Travel + Leisure Co. common stock at the close of business on that date are entitled to vote at the meeting and any adjournment or postponement of the meeting for which no new record date is set.

| | | | | | | | | | | | | | | | | |

| USE THE INTERNET http://www.proxyvote.com | | CALL TOLL-FREE 1-800-690-6093 | | MAIL YOUR PROXY CARD |

Notice of 2025 Annual Meeting of Shareholders

How to Attend the Meeting:

The meeting will begin promptly at 12:30 p.m. Eastern Time on May 21, 2025. Shareholders of record and beneficial holders at the close of business on March 26, 2025 may attend the meeting and vote their shares during the meeting at www.virtualshareholdermeeting.com/TNL2025. Shareholders will have the same opportunities to participate as they would at an in-person meeting with the opportunity to vote and submit questions during the virtual meeting using the directions on the meeting website. Shareholders will need their 16-digit control number to vote or ask questions during the meeting. The control number can be found on the Notice of Internet Availability, proxy card or voting instruction form. Those without a control number may attend as guests of the meeting but will not have the option to vote their shares or ask questions.

Beneficial shareholders whose shares are registered in the name of a bank, broker or other nominee will need to obtain the information required to be able to participate in, and vote at, the meeting, including their control number, from their bank, broker or other nominee. If a beneficial holder has any questions regarding attendance at the meeting or how to obtain a control number, they should contact their bank, broker or other nominee who holds their shares.

Online access to the meeting will open 15 minutes prior to the start of the meeting to allow time for participants to login and to test their device audio systems. We encourage participants to access the meeting in advance of the designated start time. After logging in, please review the rules of conduct for the meeting posted on the website.

Support will be available 15 minutes prior to, and during, the meeting to assist shareholders with any technical difficulties they may have accessing or hearing the virtual meeting. If participants encounter any difficulty, they should call the support team at the numbers listed on the login screen.

Information About the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our 2024 Annual Report, to all of our shareholders, we provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. As more fully described in the Notice of Internet Availability of Proxy Materials, shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Proxy Voting:

We are, on behalf of our Board, soliciting your proxy to vote your shares at our 2025 annual meeting. We solicit proxies to give all shareholders of record an opportunity to vote on matters that will be presented at the annual meeting.

Your vote is important. Please vote your proxy promptly so your shares are represented, even if you plan to attend the annual meeting. You may vote by Internet, by telephone, by requesting a printed copy of the proxy materials and using the enclosed proxy card or at the annual meeting.

Our proxy tabulator, Broadridge Financial Solutions, must receive your proxy by 11:59 p.m. Eastern Time on Tuesday, May 20, 2025. If you have shares of common stock credited to your account under the Company's Employee Savings Plan, the trustees must receive your voting instructions by 11:59 p.m. Eastern Time on Friday, May 16, 2025.

By order of the Board of Directors,

JAMES SAVINA

General Counsel & Corporate Secretary

April 11, 2025

TABLE OF CONTENTS

COMPANY OVERVIEW

LEADER IN THE VACATION OWNERSHIP INDUSTRY

Travel + Leisure Co. is the world’s leading vacation ownership and membership travel company. We provide vacation experiences and travel inspiration to millions of owners, members, and subscribers through our diverse portfolio of products and services. Travel + Leisure Co. has the following segments:

•Vacation Ownership includes the world’s largest vacation ownership business. We provide vacation ownership experiences under some of the most popular hospitality and leisure brands, including Club Wyndham, WorldMark by Wyndham, Margaritaville Vacation Club, and Accor Vacation Club. We are also currently developing a new experiential product celebrating the Sports Illustrated brand in the U.S.

•Travel and Membership includes our Exchange and Travel Club business lines. RCI is the world’s largest exchange company. Our Travel Club business line includes: our RCI travel club, which seeks to capture a greater share of our members non-exchange travel budgets; and our business-to-business travel clubs, which offer private-label solutions to associations, organizations, and other closed user groups.

BY THE NUMBERS(1)

| | | | | | | | | | | | | | | | | |

| 50+ YEARS As a Leader in the Industry | | 3.4 MILLION RCI Members | | 800,000+ Timeshare Owners |

| | | | | |

| 19,000 Associates Globally | | 3,600 RCI Affiliated Resorts | | 270+ Vacation Club Resort Locations Worldwide |

(1)As of December 31, 2024. |

| | | | | |

| |

| OUR PORTFOLIO OF GLOBAL BRANDS |

| |

| |

| |

| |

2024 Business Performance Highlights(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

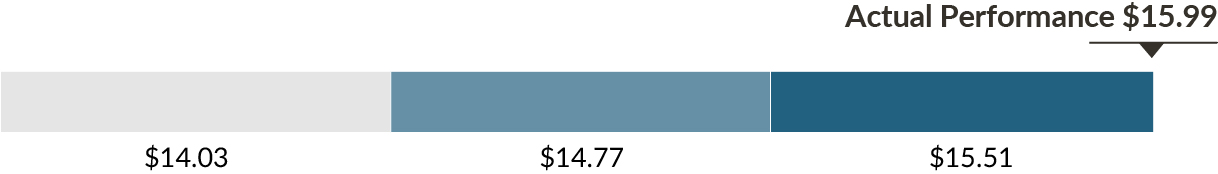

| Net Revenue $3.9B | | | Net Income attributable to TNL shareholders $411M | | | Net Cash Provided by Operating Activities $464M | | | Diluted EPS $5.82 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Share Repurchases + Dividends $377M | | | Adj EBITDA(2) $929M | | | Adj. FCF(2) $446M | | | Adjusted Diluted EPS(2) $5.75 | |

| | | | | | | | | | | |

| | | | | |

| |

| HIGHLIGHTS |

| |

| |

+Achieved 8% tour growth year-over-year +Continued shareholder-focused capital allocation strategy +Achieved 35% new owner transaction mix and VPG over $3,000 | +Acquired Accor Vacation Club +Launched new Club Wyndham mobile app +Achieved 3.3x year-end leverage ratio for covenant purposes |

| |

| | | | | |

| |

CORPORATE RESPONSIBILITY PROGRESS AND SELECT AWARDS(3) |

| |

| |

+Reduced water withdrawal per square foot by 14% +Increased renewable energy consumption to 3% +Achieved goal of planting two million trees by 2025 in partnership with the Arbor Day Foundation +Reduced Scope 1 + Scope 2 GHG emissions intensity by 39% +USA Today’s America’s Climate Leaders +Fortune’s World’s Most Admired Companies | +Travel + Leisure Charitable Foundation partnered with the School District of Osceola County, Florida to include a second community in the Travel + Leisure Scholarship Program and provide scholarships to qualifying Osceola County students beginning in the 2024-2025 school year +Newsweek’s America’s Most Responsible Companies +Time’s Best Mid-Size Companies |

| |

Where You Can Find Additional Corporate Responsibility Information Detailed information about our governance practices is included below under “Corporate Governance.” For additional information about our environmental and social responsibility activities and initiatives, see Part I Item 1—Business—Corporate Responsibility, of our Annual Report filed with the SEC, which can be found on our website at investor.travelandleisureco.com/sec-filings/annual-reports, and visit our website at investor.travelandleisureco.com/esg. Information from our website is not incorporated by reference into this proxy statement. |

| |

(1)For the twelve months ended December 31, 2024.

(2)Non-GAAP measure: see appendices for reconciliations and definitions.

(3)The percentage change noted is against our 2010 baseline as of December 31, 2023.

PROXY STATEMENT SUMMARY

This proxy statement contains information on the following matters that will be presented at the 2025 Annual Meeting of Shareholders (Annual Meeting) and is provided to assist you in voting your shares.

| | | | | | | | | | | |

| Proposals | Voting Matter | Board Vote

Recommendation | Page

Reference |

| | | |

| 1 | To elect nine Directors for a term expiring at the 2026 annual meeting of shareholders | FOR ALL of the director nominees | |

| | | |

| | | |

| 2 | To vote on a non-binding, advisory basis to approve our executive compensation program (“say-on-pay vote”) | FOR | |

| | | |

| | | |

| 3 | To vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2025 | FOR | |

| | | |

On or about April 11, 2025, we will begin mailing a Notice of Internet Availability of Proxy Materials to all shareholders of record as of March 26, 2025 and will post our proxy materials on the website referenced above and in the Notice. For additional information about the Annual Meeting, please see FAQs about the Annual Meeting on page 84. Election of Directors

The Travel + Leisure Co. Board of Directors (Board) is comprised of a highly experienced, diverse and engaged group of individuals. The Board has nominated our nine current Directors for election at the Annual Meeting for a term expiring at the 2026 annual meeting of shareholders, consistent with the recommendation of the Corporate Governance Committee.

Snapshot of 2025 Board Nominees

The following table provides summary information about our Director nominees. Your Board recommends that you vote “FOR ALL” the election of each of the nine nominees. Detailed biographical information about each Director nominee begins on page 14. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nominee Name & Biography Snapshot | Age | Director

Since | Independent | Committee Member |

| A | C | E | G |

| | | | | | | | |

| Stephen P. Holmes Non-Executive Chairman and former

Chairman & CEO, Travel + Leisure Co.

(f/k/a Wyndham Worldwide Corp.) | 68 | 2006 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Louise F. Brady Co-founder and Managing Partner,

Piedmont Capital Partners, LLC,

Piedmont Capital Partners II, LLC, and

Piedmont Capital Investments, LLC | 60 | 2016 | |  f f | | | |

| | | | | | | | |

| | | | | | | | |

| Michael D. Brown President and Chief Executive Officer,

Travel + Leisure Co. | 54 | 2018 | | | | | |

| | | | | | | | |

| | | | | | | | |

| James E. Buckman* Former Vice Chairman

York Capital Management | 80 | 2006 | | | | | |

| | | | | | | | |

| | | | | | | | |

| George Herrera President and Chief Executive Officer,

Herrera-Cristina Group, Ltd. | 68 | 2006 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Lucinda C. Martinez Chief Marketing Officer, HarbourView Equity Partners Founder, THE CULTURESHAKER by LuMark, LLC | 54 | 2021 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Denny Marie Post Former Co-President, Nextbite | 68 | 2018 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Ronald L. Rickles Former Senior Partner, Deloitte & Touche LLP | 73 | 2018 | |  f f | | | |

| | | | | | | | |

| | | | | | | | |

| Michael H. Wargotz Former Chairman, Axcess Ventures | 66 | 2006 | |  f f | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| * Lead Director | C Compensation | G Corporate Governance | | Member |

| A Audit | E Executive | | Chair | f | Financial Expert |

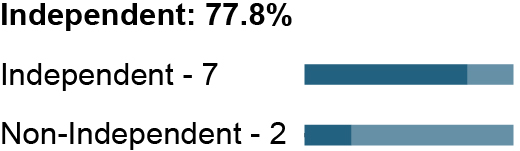

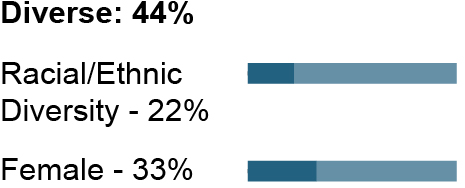

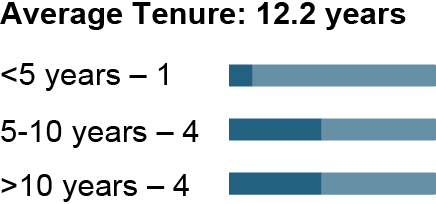

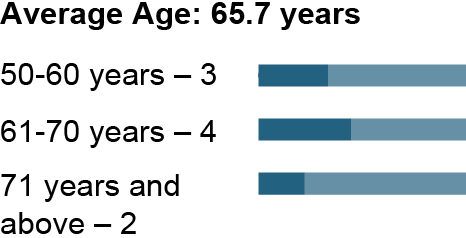

2025 Board Nominee Statistics

| | | | | |

| |

Independence | Diversity (Gender & Race) |

| |

| |

Tenure | Age |

| |

Board Refreshment Since 2018

The Board recognizes the importance of Board refreshment to achieve the appropriate mix of the institutional knowledge and experience of our longer-tenured Directors together with the fresh perspectives of our newer Directors. In May 2018, Wyndham Worldwide Corporation, as we were formerly known, completed the spin-off of its Hotel Group business, which became a new, publicly-traded hotel franchising and hotel management company, Wyndham Hotels & Resorts, Inc. (Wyndham Hotels). Four of nine Directors, comprising 44% of the Board, have joined the Board in or following 2018.

| | | | | | | | | | | | | | | | | | | | | |

| |

| | |

| } | |

| | | | | | |

| | 2018 | | | 2021 | |

| | | | | | |

| | | | | | |

| | •Stephen P. Holmes, our former CEO, resigned from that position and became the Non-Executive Chairman of our Board, and the Board appointed Mr. Brown as a member of the Board and President and CEO. •Directors Myra J. Biblowit, The Right Honourable Brian Mulroney and Pauline D.E. Richards resigned (joining the Wyndham Hotels Board) •Ms. Post and Mr. Rickles joined the Board. Ms. Brady was appointed Chair of Compensation Committee. | | | •Ms. Martinez joined the Board. •Chair of Audit Committee rotated from Mr. Wargotz to Mr. Rickles. | |

| | | | |

| | | | |

| | ¢ | | |

| ¢ | | | |

Collective Skills

Each Director nominee has the skills, experience and personal qualities the Board seeks in its Directors, and the Board believes that the combination of these nominees creates an effective and well-functioning Board.

Following are the key qualifications, attributes and skills our Director nominees collectively bring to the Board:

| | | | | | | | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership | | Global Perspective |

| | | | | | | |

| | | | | | | |

| Government Affairs / Legal | | Hospitality or Consumer Driven Industries | | Human Capital Management | | Other Current Public Company Board Service |

| | | | | | | |

| | | | | | | |

| Risk Management | | Sales and Marketing | | Sustainability and Corporate Responsibility | | Technology |

| | | | | | | |

2024 Executive Compensation Overview

Our Total Compensation Strategy is designed to achieve the following objectives:

| | | | | | | | | | | |

| Attract, retain and motivate high-performing senior management talent. | | Support a high-performance environment by linking compensation with performance. |

| Provide our executives with compensation that is consistent and competitive with compensation provided by comparable hospitality, service and leisure companies. | | Support a long-term focus for our executives that aligns with shareholder interests. |

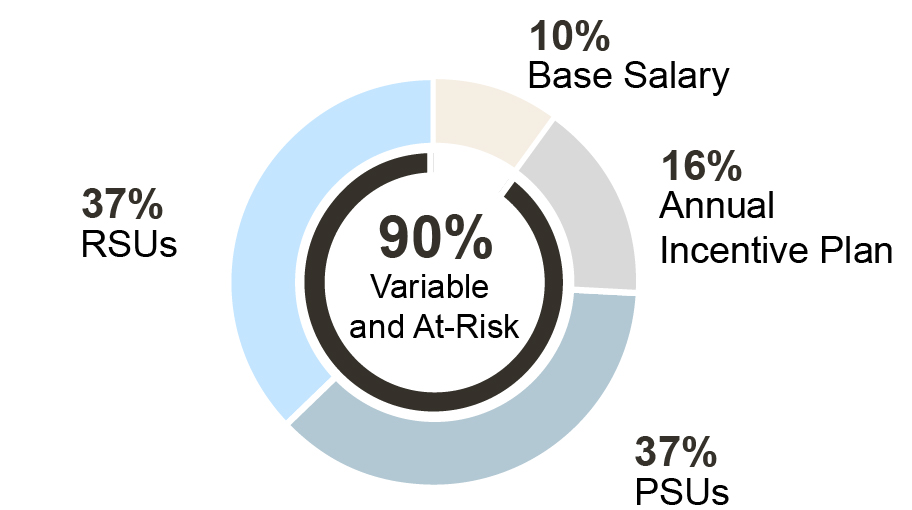

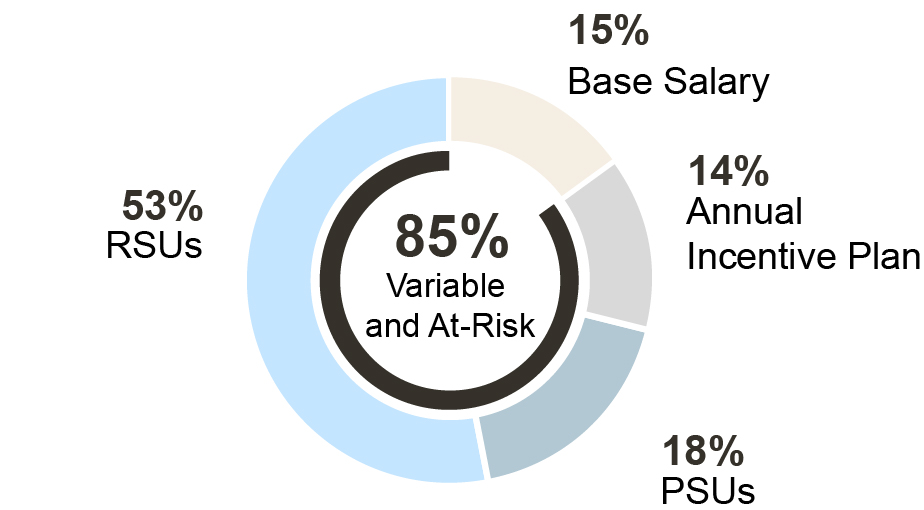

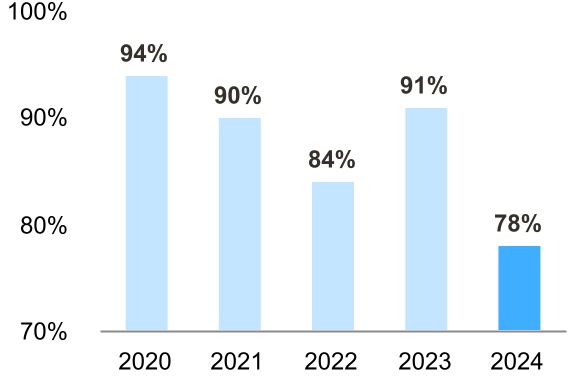

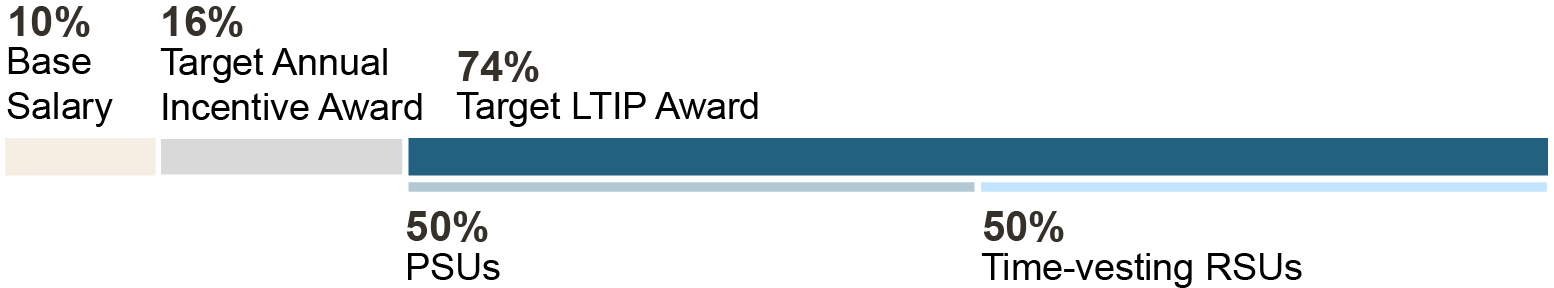

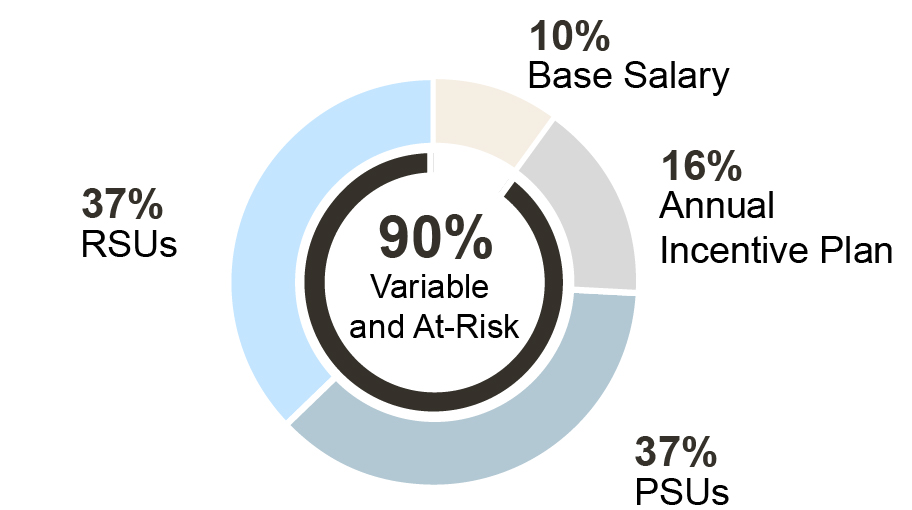

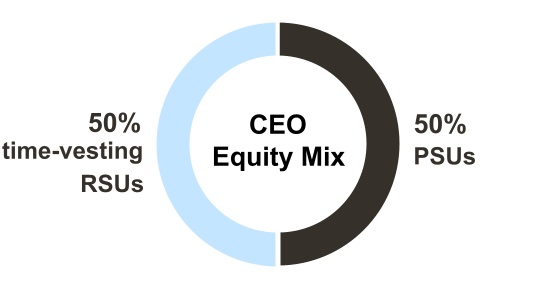

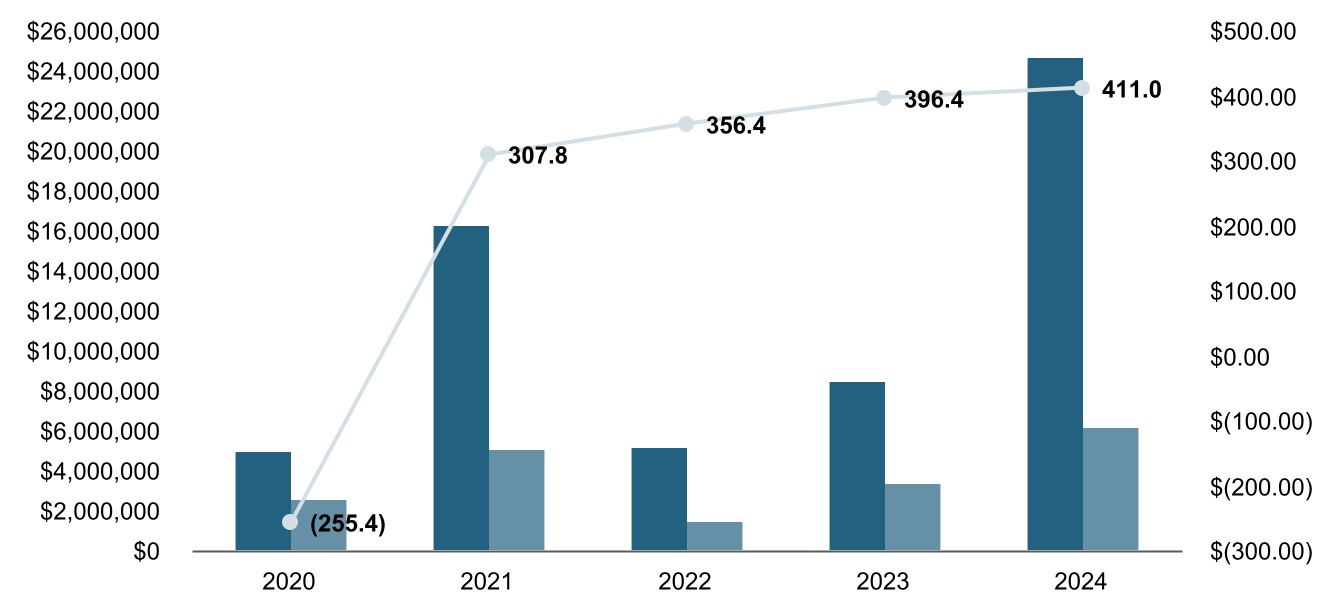

CEO and NEO Pay Mix

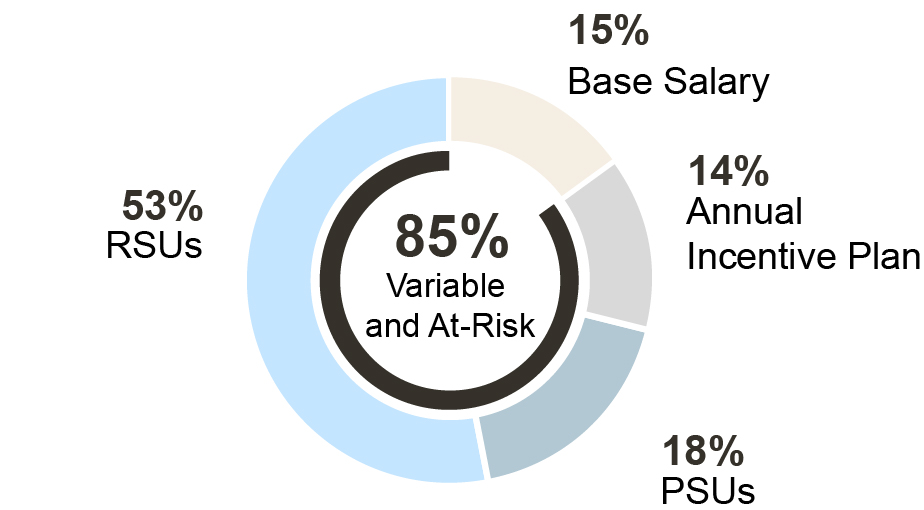

Other NEO Compensation Mix

Elements of Compensation

| | | | | | | | | | | | | | |

| Element | | Type | Form | Compensation Highlights |

| | | | |

| Base Salary | | Fixed | Cash | •Designed to attract and retain our named executive officers (NEOs) and provide them with a base level of income consistent with our Total Compensation Strategy. •Base salary increases were consistent with the broader employee population. Our CEO did not receive a base salary increase for 2024. |

| | | | |

| | | | |

| Annual Incentive | | Variable,

At-Risk,

Short-Term | Cash | •Continued performance goals measured against corporate and business unit adjusted EBITDA targets for the CEO and senior leadership team. •Adjusted EBITDA weighting increased from 90% to 100% to further align CEO and NEOs with shareholders by further emphasizing adjusted EBITDA delivery through execution of our annual plan. •Continued maximum payout opportunity at 200% of target annual incentive award for premium performance levels. |

| | | | |

| | | | |

| Long-Term Incentive | | Variable,

At-Risk,

Long-Term | PSUs and

time-vesting

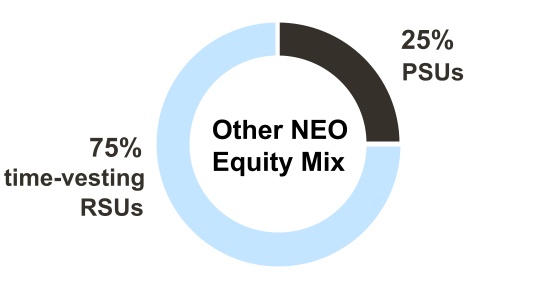

RSUs | •Approved implementation of a retirement provision in long-term incentive equity plan to incentivize our senior leaders to plan for succession in the case of retirement from the Company. •The 2024 target LTIP award for our CEO consists of 50% PSUs and 50% time-vesting RSUs. •The 2024 target LTIP awards of other NEOs consist of 25% PSUs and 75% time-vesting RSUs. •These PSUs are to be earned upon achievement of three-year average performance against Adjusted Diluted earnings per share (EPS) for the performance period 2024 to 2026. This approach provides alignment with long-term performance while providing the flexibility to adapt to shifting market conditions and macroeconomic uncertainties. |

| | | | |

Compensation Governance Highlights

| | | | | |

| |

| |

WHAT WE DO | WHAT WE DON’T DO |

| |

•Require achievement of rigorous financial performance metrics designed to incentivize high-performance and achievement of short-term financial goals in our annual incentive compensation program and thus creates value for our shareholders. •Design equity awards granted to our NEOs under our long-term incentive plan to align their interests with our shareholders' interests. Regular annual equity awards constitute, on average, approximately 71% of the annual target total direct compensation of our NEOs and vest over multi-year periods. •Include a performance-based equity incentive award in our incentive compensation program, the vesting of which is contingent upon achievement of performance goals over a three-year period, incentivizing medium-term high performance and value growth for our shareholders. •Continue our shareholder outreach program to seek feedback on our governance and executive compensation practices. | •No tax gross-ups on perquisites for our CEO. •No hedging transactions in our equity securities, nor pledging or using our securities as collateral to secure personal loans or other obligations, including holding shares in a margin account, are permitted for our Directors and senior executives. •No right given to our NEOs to receive cash severance based solely upon change-in-control. Severance agreements with respect to cash severance payments are double trigger following the occurrence of a change-in-control. •No tax gross-up in connection with severance payments upon termination of employment for our executive officers. |

| |

| | | | | | | | | | | | | | |

| | | | |

| Proposal 1: ELECTION OF DIRECTORS The Travel + Leisure Co. Board of Directors (Board) is comprised of a highly experienced, diverse and engaged group of individuals. The Board has nominated our nine current Directors for election at the Annual Meeting for a term expiring at the 2026 annual meeting of shareholders, consistent with the recommendation of the Corporate Governance Committee. | |

| | | |

| | Our Board unanimously recommends that shareholders vote “FOR ALL” of the nominees for director. | |

| | |

| | | | |

Overview

Each Director nominee has agreed to be named in this proxy statement and if elected to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal. Accordingly, we do not know of any reason why any nominee would be unable to serve as a Director. If any nominee is unable or unwilling for good cause to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate to the extent permitted by applicable law or rule.

Proposal 1: Election of Directors

Our Board Nominees

Board of Directors Skills and Experience Matrix

The Board believes that having Directors with a range of experience, skills and understanding of our business is important to setting and achieving our Company’s strategic objectives and in satisfying the Board’s oversight responsibilities. The following matrix provides information about certain skills, experience and attributes possessed by one or more of our Director nominees which our Board believes are relevant to our business and operations. This matrix does not encompass all of the skills, experience or attributes of our Director nominees and does not suggest that a Director nominee who is not listed as having a particular, skill, experience or attribute does not have valuable insight into areas associated with that particular subject area. Additional detail about our Directors’ background, skills and experience is included in each Director’s biography following this matrix.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions experience supports pursuing strategic transactions and expanding our multi-brand portfolio | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Corporate Finance and Accounting experience supports advising executive management regarding our capital structure and capital allocation strategy and providing oversight of our financial reporting | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Executive Leadership experience is indicative of strong personal leadership qualities and capability to advise our executive management team on a wide range of strategic, operational and practical issues | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Global Perspective provides valuable perspective into our global footprint and international growth initiatives | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Government Affairs / Legal experience is useful as we operate in an increasingly regulated global environment | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Hospitality or Consumer Driven Industries experience supports serving our consumers, developing strategies to grow sales and market share, building brand awareness, and enhancing enterprise reputation | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Human Capital Management experience provides an understanding of how we attract and retain top executive talent, manage and develop our workforce. | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Other Current Public Company Board Service helps the Board’s understanding of corporate governance, the dynamics and operation of a public corporate board, the legal and regulatory landscape in which public companies operate, and practical oversight of strategy, risk management and growth | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Risk Management experience reflects the ability to respond to the challenges that come with operating a dynamic global business | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Sales and Marketing experience supports our business around the world as we grow our brands and engage with our guests and customers across multiple platforms | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Sustainability and Corporate Responsibility experience supports our commitment to operate sustainably, ethically, and with respect for people and places worldwide | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Technology experience supports oversight of and insight into technological innovation to enhance customer engagement and safeguard data | | | | | | | | | | | |

| | | | | | | | | | | | |

Proposal 1: Election of Directors

Director Biographies

Included in the biography for each Director nominee is a description of select key qualifications and experience that led the Board to conclude that each nominee is qualified to serve as a member of the Board. All biographical information below is as of the Record Date.

| | | | | | | | |

| | |

| Stephen P. Holmes |

| | |

| | |

| Non-Executive Chairman |

| |

Age: 68 Director Since: 2006 Committees: Executive (Chair) | Other Current Public Company Directorships: Wyndham Hotels Former Public Company Directorships: Cendant Corporation (Cendant) and HFS Incorporated (HFS) |

| | |

| | |

| Career Highlights: |

•Chairman and Chief Executive Officer, Travel + Leisure Co. (f/k/a Wyndham Worldwide Corp), July 2006 – May 2018 •Vice Chairman and Director, Cendant, December 1997 – July 2006 •Chairman and Chief Executive Officer, Cendant’s Travel Content Division, December 1997 – July 2006 | •Vice Chairman, HFS, September 1996 - December 1997 •Executive Vice President, Treasurer and Chief Financial Officer, HFS, July 1990 - September 1996 •Non-Executive Chairman, Wyndham Hotels, May 2018 - Present |

| | |

Skills and Qualifications: Mr. Holmes’ exceptional leadership as our former CEO provides him with detailed strategic perspective and knowledge of our operations and industry that are critical to the Board’s effectiveness. He possesses extensive public company management experience and is widely recognized as a visionary leader in the global hospitality industry. Under Mr. Holmes’ leadership, we completed the spin-off of Wyndham Hotels and continue to focus our business on, among other things, generating significant earnings and cash flow and building world-renowned hospitality brands, all of which continue to increase shareholder value. Mr. Holmes’ specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Holmes should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Global Perspective | | Hospitality or Consumer Driven Industries | | Human Capital Management |

| Other Current Public Company Board Service | | Risk Management | | Sustainability and Corporate Responsibility |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Louise F. Brady | Independent |

| | |

| | |

| Co-founder and Managing Partner of Piedmont Capital Partners, LLC, Piedmont Capital Partners II, LLC, and Piedmont Capital Investments, LLC |

| |

Age: 60 Director Since: 2016 Committees: Audit, Compensation (Chair) | Other Current Public Company Directorships: Comcast Corporation Former Public Company Directorships: None |

| | |

| | |

| Career Highlights: |

•Co-founder and Managing Partner, Piedmont Capital Partners, LLC, a privately held venture capital fund focusing on developing innovative technologies, March 2013 – Present •Co-founder and Managing Partner, Piedmont Capital Partners II, LLC (PCP II), March 2019 – Present •Co-founder and Managing Partner, Piedmont Capital Investments, LLC (PCI), February 2020 – Present •President, Blue Current, Inc., a manufacturer of sustainable solid state batteries using innovative battery technology, May 2014 – April 2022 | •Vice President of Investments, Wells Fargo Financial Advisors Financial Services, September 1996 - October 2013 •Board Member, Blue Current, Inc. •Board Member, Piedmont Triad Partnership •Board Member, The Bryan Foundation •Co-Chair, Advisory Board, The Shuford Program in Entrepreneurship at University of North Carolina-Chapel Hill |

| | |

Skills and Qualifications: Ms. Brady has spent her career focused on leading investment strategies and unlocking growth and value through developing innovative technologies in start-up companies, commercial banking and venture capital portfolio management. Ms. Brady’s exceptional background and skills contribute financial expertise and perspective on innovation to our Board in areas that are important to our business. Ms. Brady’s specific experience, qualifications and skills described above led the Board to conclude that Ms. Brady should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Hospitality or Consumer Driven Industries | | Human Capital Management | | Other Current Public Company Board Service |

| Risk Management | | Technology | | |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Michael D. Brown | |

| | |

| | |

| President and Chief Executive Officer, Travel + Leisure Co. |

| |

Age: 54 Director Since: 2018 Committees: Executive | Other Current Public Company Directorships: None Former Public Company Directorships: None |

| | |

| | |

| Career Highlights: |

•President and Chief Executive Officer, Travel + Leisure Co., May 2018 – Present, and President and Chief Executive Officer, Vacation Ownership 2017 - May 2018 •Chief Operating Officer, Hilton Grand Vacations (HGV), 2014 – 2017 | •Executive Vice President, Sales and Marketing-Mainland U.S. and Europe, HGV, 2008 – 2014 •Series of leadership roles throughout the U.S., Europe and the Caribbean, Marriott International and Marriott Vacation Club International, 1992 – 2008 |

| | |

Skills and Qualifications: A leisure travel industry veteran of more than 30 years, Mr. Brown’s leadership is infused with a combination of strategic vision, operational expertise, authentic engagement, and industry knowledge. In addition, Mr. Brown drives the Company's commitment to be responsive and engaged through socially conscious initiatives, and fosters its global spirit of hospitality and responsible tourism. Mr. Brown’s specific experience, qualifications and skills described above led the Board to conclude that Mr. Brown should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Global Perspective | | Hospitality or Consumer Driven Industries | | Human Capital Management |

| Risk Management | | Sales and Marketing | | Sustainability and Corporate Responsibility |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| James E. Buckman | Independent |

| | |

| | |

| Lead Director; Former Vice Chairman, York Capital Management |

| |

Age: 80 Director Since: 2006 Committees: Compensation, Executive | Other Current Public Company Directorships: Wyndham Hotels Former Public Company Directorships: Cendant and HFS |

| | |

| | |

| Career Highlights: |

•Vice Chairman, York Capital Management, May 2007 – January 2012 •General Counsel, York Capital Management, May 2010 – January 2012 •Senior Consultant, York Capital Management, January 2007 – May 2007 •Vice Chairman, Cendant, November 1998 – August 2006 | •General Counsel, Cendant, December 1997 – August 2006 •Senior Executive Vice President, Cendant, December 1997 – November 1998 •Senior Executive Vice President, General Counsel and Assistant Secretary, HFS, May 1997 – December 1997 •Executive Vice President, General Counsel and Assistant Secretary, HFS, February 1992 – May 1997 |

| | |

Skills and Qualifications: Mr. Buckman brings to the Board exceptional leadership, experience and perspective necessary to be our Lead Director. His service as a director, Vice Chairman and General Counsel of Cendant and a Director of Wyndham Hotels affords Mr. Buckman strong experience with Travel + Leisure Co.’s business and operations. Mr. Buckman’s experience with leading hedge fund manager York Capital Management contributes valuable cross-industry experience and depth of knowledge. Mr. Buckman’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Buckman should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Global Perspective | | Government Affairs / Legal | | Hospitality or Consumer Driven Industries |

| Human Capital Management | | Other Current Public Company Board Service | | |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| George Herrera | Independent |

| | |

| | |

| President and Chief Executive Officer, Herrera-Cristina Group, Ltd. |

| |

Age: 68 Director Since: 2006 Committees: Audit, Corporate Governance (Chair) | Other Current Public Company Directorships: None Former Public Company Directorships: Cendant |

| | |

| | |

| Career Highlights: |

•President and Chief Executive Officer, Herrera-Cristina Group, Ltd., a Hispanic-owned, multidisciplinary management firm, December 2003 – Present •President and Chief Executive Officer, U.S. Hispanic Chamber of Commerce, August 1998 – January 2004 | •President, David J. Burgos & Associates, Inc., December 1979 – July 1998 •Chair, Board of Directors, Hispanic C-Suite Corporate Council (HC3) |

| | |

Skills and Qualifications: Mr. Herrera provides the Board with exceptional leadership and management knowledge. As a Cendant director and a Director and Chair of the Corporate Governance Committee of Travel + Leisure Co., Mr. Herrera has gained a broad understanding of the role of the Board in our operations. Mr. Herrera’s service as chief executive officer of multidisciplinary management firm Herrera-Cristina Group, Ltd. contributes extensive and varied management, finance and corporate governance experience. His prior service as President and CEO of the U.S. Hispanic Chamber of Commerce brings valuable government relations expertise to the Board. Mr. Herrera’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Herrera should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Corporate Finance and Accounting | | Executive Leadership | | Global Perspective |

| Government Affairs / Legal | | Hospitality or Consumer Driven Industries | | Human Capital Management |

| Sustainability and Corporate Responsibility | | | | |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Lucinda C. Martinez | Independent |

| | |

| | |

| Chief Marketing Officer, HarbourView Equity Partners

Founder, THE CULTURESHAKER by LuMark, LLC |

| |

Age: 54 Director Since: 2021 Committees: Corporate Governance | Other Current Public Company Directorships: None Former Public Company Directorships: None |

| | |

| | |

| Career Highlights: |

•Chief Marketing Officer, HarbourView Equity Partners, a global multi-strategy investment firm focused on opportunities in the entertainment, sports, and media space, December 2024 – Present •Founder, THE CULTURESHAKER by LuMark, LLC, a marketing consulting firm providing media clients with a culture-first strategic approach to driving awareness and engagement across targeted audiences through culturally aligned advertising and promotional tactics, May 2022 – Present •Vice President, Global Brand & Multicultural Marketing, Netflix, Inc., September 2021 – June 2022 | •Nearly 20 years with Warner Media, a media company with a portfolio of iconic entertainment, news, and sports brands, in roles of increasing responsibility, including: +Executive Vice President, Brand Marketing HBO and HBO Max, August 2020 to March 2021 +Executive Vice President, Multicultural Marketing, Brand & Inclusion Strategy, Warner Media, September 2019 to August 2020 •Member of the Board of Trustees of The Alvin Ailey American Dance Theater •Member of the Advisory Board of The Hispanic Scholarship Fund |

| | |

Skills and Qualifications: Ms. Martinez is an accomplished media and entertainment industry executive with expertise in the global marketing of subscription businesses for two of the world’s most successful digital media companies, HBO and Netflix. She brings world-class experience in subscriber business development, digital and diverse marketing strategies, and brand management to the Board. Ms. Martinez's specific experience, qualifications, attributes and skills described above led the Board to conclude that Ms. Martinez should serve as our Director. |

| | | | | | | | | | | | | | | | | | | | |

| Executive Leadership | | Global Perspective | | Hospitality or Consumer Driven Industries | |

| Human Capital Management | | Sales and Marketing | | Sustainability and Corporate Responsibility | |

| Technology | | | | | |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Denny Marie Post | Independent |

| | |

| | |

| Former Co-President, Nextbite |

| |

Age: 68 Director Since: 2018 Committees: Compensation, Corporate Governance | Other Current Public Company Directorships: Vital Farms, Inc. Former Public Company Directorships: Red Robin Gourmet Burgers Inc. |

| | |

| | |

| Career Highlights: |

•Co-President, Nextbite, a virtual restaurant and a pioneer in online order management, June 2022 – May 2023 •President and Chief Executive Officer, Red Robin Gourmet Burgers Inc., August 2016 – April 2019 •President, Red Robin Gourmet Burgers Inc., February 2016 – August 2016 •Executive Vice President and Chief Concept Officer, Red Robin Gourmet Burgers Inc., March 2015 – February 2016 •Senior Vice President and Chief Marketing Officer, Red Robin Gourmet Burgers Inc., August 2011 – March 2015 | •Prior to her role at Red Robin, Ms. Post served as: +Senior Vice President and Chief Marketing Officer, T-Mobile USA +Senior Vice President of Global Beverage, Food and Quality, Starbucks Corporation +Senior Vice President and Chief Concept Officer, Burger King +Several management positions for KFC USA, KFC, Pizza Hut and Taco Bell Canada while employed with YUM! Brands, Inc. •Board member of Bluestone Lane Holdings •Board member of Libbey Glass |

| | |

Skills and Qualifications: Ms. Post’s more than 30 years of senior management experience in the consumer driven industry brings extensive sales, marketing, product innovation and management and strategic team building expertise to Travel + Leisure Co. and this is of significant value to the Board. As a member of the Compensation and Governance Committees of Travel + Leisure Co., Ms. Post has gained a broad understanding of the role of the Board in our operations. Ms. Post’s prior service as chief executive officer of a publicly traded company contributes extensive leadership, marketing and brand management experience and provides the Board with expertise that is critical to our business. Ms. Post’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Ms. Post should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Executive Leadership | | Global Perspective | | Hospitality or Consumer Driven Industries |

| Human Capital Management | | Other Current Public Company Board Service | | Risk Management |

| Sales and Marketing | | Sustainability and Corporate Responsibility | | |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Ronald L. Rickles | Independent |

| | |

| | |

| Former Senior Partner, Deloitte & Touche LLP |

| |

Age: 73 Director Since: 2018 Committees: Audit (Chair), Corporate Governance | Other Current Public Company Directorships: None Former Public Company Directorships: None |

| | |

| | |

| Career Highlights: |

•Senior Partner with Deloitte & Touche LLP, until his retirement in 2014, serving in a variety of leadership roles, including managing partner for the New Jersey offices and Northeast regional leader of the firm’s professional services practice for mid-market and privately held companies. | •Served as an audit partner with Deloitte & Touche LLP for 30 years, with deep experience serving the hospitality industry (including timeshare), REITs, retailers, financial services companies and franchisors, including the legacy businesses of Travel + Leisure Co. |

| | |

Skills and Qualifications: Mr. Rickles has significant boardroom experience advising client audit committees on financial reporting, internal controls, investigations and corporate governance. He also has substantial experience and expertise working with and advising senior management on complex transactions, including mergers and acquisitions, sales, and capital market activities. Mr. Rickles’ service as Chair of the Audit Committee together with his extensive financial background and exceptional leadership experience provides the Board with financial accounting and management expertise and perspectives. Mr. Rickles’ specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Rickles should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Hospitality or Consumer Driven Industries | | Human Capital Management | | Risk Management |

Proposal 1: Election of Directors

| | | | | | | | |

| | |

| Michael H. Wargotz | Independent |

| | |

| | |

| Former Chairman, Axcess Ventures |

| |

Age: 66 Director Since: 2006 Committees: Audit, Compensation, Executive | Other Current Public Company Directorships: None Former Public Company Directorships: Quotient Technology Inc., Resources Connection, Inc., CST Brands, Inc. |

| | |

| | |

| Career Highlights: |

•Chairman, Axcess Ventures, an affiliate of Axcess Worldwide, a brand experience marketing development agency, which he co-founded in 2001, July 2011 - June 2017 •Chief Financial Officer, The Milestone Aviation Group, LLC, a global aviation leasing company, August 2010 – June 2011 •Co-Chairman, Axcess Luxury and Lifestyle, August 2009 – July 2010 •Chief Financial Advisor, NetJets, Inc., a leading provider of aviation services, December 2006 – August 2009 •Vice President, NetJets, Inc., June 2004 – November 2006 | •Various leadership positions, Cendant, January 1998 –December 1999, including: +President and Chief Executive Officer of its Lifestyle Division +Executive Vice President and Chief Financial Officer of its Alliance Marketing Segment +Senior Vice President, Business Development •Prior to 1998, served in various finance and accounting positions at HFS Incorporated, PaineWebber & Co, American Express and Price Waterhouse |

| | |

Skills and Qualifications: Mr. Wargotz is a private investor involved with various start-up ventures. His senior management experience brings to the Board financial enterprise and branding knowledge. As past Chair of the Audit Committee of Travel + Leisure Co., he contributes financial reporting and compliance expertise and perspective. Mr. Wargotz’s experience provides the Board with exceptional leadership and branding and business development expertise in areas that are critical to our business. Mr. Wargotz’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Wargotz should serve as our Director. |

| | | | | | | | | | | | | | | | | |

| Business Development / Mergers & Acquisitions | | Corporate Finance and Accounting | | Executive Leadership |

| Hospitality or Consumer Driven Industries | | Human Capital Management | | Sales and Marketing |

| | | | | |

Proposal 1: Election of Directors

Director Independence

Travel + Leisure Co.’s Corporate Governance Guidelines and Director Independence Criteria define our standards for director independence and reflect applicable New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) requirements. All members of the Audit Committee and the Compensation Committee must also meet heightened independence standards under applicable NYSE and SEC rules.

Our Board is required under NYSE rules to affirmatively determine that each independent Director has no material relationship with Travel + Leisure Co. impacting his or her independence.

In accordance with these standards and criteria, the Board undertook its annual review of the independence of its Directors. During this review the Board considered whether there are any relationships or related party transactions between each Director, any member of his or her immediate family or other affiliated entities and us and our subsidiaries and affiliates. The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the Director is independent.

The Board follows a number of procedures to review related party transactions. We maintain a written policy governing related party transactions that requires Audit Committee pre-approval of related party transactions exceeding $120,000. Each Board member answers a questionnaire designed to disclose conflicts and related party transactions. We also review our internal records for related party transactions. Based on a review of these standards and materials, none of our independent Directors had during the past year or has any relationship with us other than as a Director within the meaning of our Director Independence Criteria and applicable regulatory and listing standards.

As a result of its review the Board affirmatively determined that the following Directors are independent of us and our management as required by the NYSE listing standards and the Director Independence Criteria: Louise F. Brady, James E. Buckman, George Herrera, Lucinda C. Martinez, Denny Marie Post, Ronald L. Rickles and Michael H. Wargotz. All members of the Audit, Compensation and Corporate Governance Committees are independent Directors within the meaning of our Director Independence Criteria and applicable regulatory and listing standards.

Voting Standard and Majority Vote Policy

Our Certificate of Incorporation and By-Laws provide for a plurality voting standard for the election of our Directors. Under a plurality voting standard the nominee for each Director position with the most votes is elected. Only votes cast “for” a nominee will be counted. Votes “withheld” and broker non-votes in the election of directors will not be counted as cast for such purpose and therefore will have no effect on the outcome of the election.

Under the Board’s Corporate Governance Guidelines, any nominee for Director in an uncontested election (such as this one where the number of nominees does not exceed the number of Directors to be elected) who receives a greater number of votes withheld from his or her election than votes for such election shall promptly tender his or her resignation following certification of the shareholder vote. The Corporate Governance Committee will promptly consider the tendered resignation and will recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the withheld votes. In making this recommendation the Corporate Governance Committee will consider all factors deemed relevant by its members.

The Board will act on the Corporate Governance Committee’s recommendation no later than at its first regularly scheduled meeting following certification of the shareholder vote but in any case, no later than 120 days following the certification of the shareholder vote. In considering the Corporate Governance Committee’s recommendation, the Board will review the factors considered by the Corporate Governance Committee and such additional information and factors the Board believes to be relevant. We will promptly publicly disclose the Board’s decision and process in a periodic or current report filed with the SEC. Any Director who tenders his or her resignation under this process will not participate in the Corporate Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. However, such Director shall remain active and engaged in all other Committee and Board activities, deliberations and decisions during this process.

Proposal 1: Election of Directors

Director Nomination Process

Role of Corporate Governance Committee

The Corporate Governance Committee is responsible for recommending to the Board the Director nominees for election to the Board. The Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board when considering potential candidates to serve on the Board.

The Corporate Governance Committee does not have a formal policy with respect to diversity. In considering candidates for the Board, the Corporate Governance Committee considers the entirety of each candidate’s credentials and believes it is essential that Directors represent diverse viewpoints, as the judgment and perspectives offered by diverse viewpoints improves the quality of decision-making and enhances the Company’s business performance. For the nomination of continuing Directors for re-election, the Corporate Governance Committee also considers the individual’s contributions to the Board.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as senior executives of large organizations as well as board experience. Certain individual qualifications, experience and skills of our Directors that led the Board to conclude that each Director should serve as our Director are described above under “Director Biographies.”

Director Recruitment Process

| | | | | |

| |

| 1 | CANDIDATE IDENTIFICATION •The process for identifying and evaluating new nominees to the Board is initiated by identifying a candidate who meets the criteria for selection as a nominee and has the specific qualities or skills being sought, based on input from members of the Board; and, when appropriate, a third-party search firm may be used, which would identify and recommend potential candidates for consideration. |

| |

| |

| 2 | CANDIDATE EVALUATION •The Corporate Governance Committee and other members of the Board will evaluate these candidates by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. |

| |

| |

| 3 | CANDIDATE INTERVIEWS •Qualified candidates will be interviewed by at least one member of the Corporate Governance Committee. |

| |

| |

| 4 | CANDIDATE RECOMMENDATION •Using the input from one or more interviews, other Board members and other information it obtains, the Corporate Governance Committee evaluates whether the candidate is qualified to serve as a Director and whether the Corporate Governance Committee should recommend to the Board that the Board nominate the candidate for election by the shareholders or to fill a vacancy or newly created position on the Board. |

| |

Proposal 1: Election of Directors

Shareholder Recommendations

Shareholder Recommendations of Nominees

The Corporate Governance Committee will consider written recommendations from shareholders for nominees for Director. Recommendations should be submitted to the Corporate Governance Committee, c/o the Corporate Secretary, and include at least the following: name of the shareholder and evidence of the person’s ownership of our common stock, number of shares owned and the length of time of ownership, name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a Director and the person’s consent to be named as a Director if recommended by the Corporate Governance Committee and nominated by the Board. To evaluate nominees for Directors recommended by shareholders, the Corporate Governance Committee intends to use a substantially similar evaluation process as described above.

Shareholder Nominations and By-Law Procedures

Our By-Laws establish procedures pursuant to which a shareholder may nominate a person for election to the Board. Our By-Laws are available on the Investors page of our website at travelandleisureco.com/investors by clicking on the Governance menu followed by the Governance Documents link. To nominate a person for election to the Board, a shareholder must submit a notice containing all information required by our By-Laws regarding the Director nominee and the shareholder and any associated persons making the nomination, including name and address, a complete biography and statement of such person’s qualifications, number of shares owned, a description of any additional interests of such nominee or shareholder and certain other specified information and representations regarding such nomination. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. We may require any proposed nominee to furnish such other information as we may require to determine his or her eligibility and qualifications to serve as a Director. Such notice must be accompanied by the proposed nominee’s consent to being named as a nominee and to serve as a Director if elected.

To nominate a person for election to the Board at our 2026 annual meeting, written notice of a shareholder nomination must be delivered to our Corporate Secretary not earlier than January 21, 2026 and not later than February 20, 2026. However, if the date of the 2026 annual meeting is not within 30 days before or after May 21, 2026, then a shareholder’s written notice will be timely if it is delivered by no later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or the notice of the date of the annual meeting was mailed, whichever occurs first. Our By-Laws require that any such notice be updated as necessary as of specified dates prior to the annual meeting. A shareholder may make nominations of persons for election to the Board at a special meeting if the shareholder delivers written notice to our Corporate Secretary not later than the close of business on the 10th day following the day on which public disclosure of the date such special meeting was made or notice of such special meeting was mailed, whichever occurs first; provided that, at a special meeting of shareholders, only such business may be conducted (including election of directors) as shall have been brought before the meeting under our notice of meeting. In addition to satisfying the requirements under our By-Laws with respect to advance notice of any nomination, any shareholder that intends to solicit proxies in support of director nominees other than the Company's Director nominees in accordance with Rule 14a-19 must postmark or transmit electronically notice to the Corporate Secretary no later than 60 calendar days prior to the anniversary of the previous year's annual meeting (no later than March 23, 2026 for the 2026 annual meeting of shareholders). Any such notice of intent to solicit proxies must comply with all the requirements of Rule 14a-19.

CORPORATE GOVERNANCE

Board of Directors

The Board is the ultimate decision-making body of the Company, except for those matters reserved for shareholders by law or pursuant to the Company’s governance instruments and those matters delegated by the Board to management. The Board is committed to exercising sound corporate governance principles and has adopted Corporate Governance Guidelines that, along with the charters of the Committees of the Board, Director Independence Criteria, Code of Conduct for associates, and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. Each document is available on the Investors page of our website at travelandleisureco.com/investors by clicking on the Governance menu followed by the Governance Documents link. The governance rules for companies listed on the NYSE and those contained in the SEC rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically.

Oversight of Strategy

The Board plays an important role in overseeing our long-term strategy, including evaluating key market opportunities, consumer trends, and competitive developments. The Board’s oversight of risk is another integral component of the Board’s oversight and engagement on strategic matters. Strategy-related matters are regularly discussed at Board meetings and, when relevant, at committee meetings. Engagement of the Board on these issues and other matters of strategic importance continues in between meetings, including through updates to the Board on significant items and discussions by the CEO and CFO with the Executive Committee of the Board on a periodic basis. Each Director is expected to and does bring to bear his or her own talents, insights, and experiences to these strategy discussions. In addition, the Board conducts an annual evaluation of the effectiveness of the CEO, including regarding establishing objectives, strategies and operations that appropriately meet the needs of shareholders, customers, associates and other stakeholders.

Independent Director Leadership of Key Board Committees

Seven of our nine current Directors are independent, and the Audit, Compensation and Corporate Governance Committees are composed solely of independent Directors. Consequently, the independent Directors directly oversee such critical items as the Company’s financial statements, executive compensation, the selection and evaluation of Directors and the development and implementation of our corporate governance programs.

Board Leadership Structure and Composition

Board Leadership Structure and Lead Director

While the Board has not mandated a particular leadership structure, historically, the positions of Chairman of the Board and CEO were held by the same person. In 2018, as a result of Mr. Holmes’ discussions with the Board about resigning as our CEO in connection with the spin-off of Wyndham Hotels and as part of its ongoing review of the Board leadership structure and succession planning process, the Board determined that the positions of Chairman and CEO should be held by separate individuals. In connection with the spin-off, effective as of May 31, 2018, the Board elected Mr. Holmes, who had served as the Chairman and CEO of the Company since July 2006, to the position of Non-Executive Chairman of the Board. At the same time, the Board also appointed Mr. Brown, our new President and CEO, as a member of our Board. The Board also recognizes the importance of having independent Board leadership and selected James E. Buckman, an independent Director who serves as a member of the Executive Committee and Compensation Committee, to serve as the Board’s Lead Director.

| | | | | |

| |

Stephen P. Holmes Non-Executive Chairman of the Board | Provides leadership to the Board by, among other things, working with the CEO, the Lead Director, and the Corporate Secretary to: •Set Board calendars; •Determine agendas for Board meetings; •Ensure proper flow of information to Board members; •Facilitate effective operation of the Board and its Committees; •Help promote Board succession planning and the orientation of new Directors, •Address issues of Director performance; •Assist in consideration and Board adoption of the Company’s long-term and annual operating plans; and •Help promote senior management succession planning. |

| |

| |

James E. Buckman Lead Director | •Serves as a key advisor to our Chairman; •Chairs executive sessions of independent Directors and provides feedback to the Chairman, •Chairs meetings of the Board in the absence of the Chairman; and •Reviews in advance, and as appropriate, consults with the Chairman regarding, the agendas for all Board meetings. |

| |

| |

Michael D. Brown President and CEO | •As a Director, promotes strategy development and execution and facilitates information flow between management and the Board; and •As President & CEO, is responsible for the performance, growth and strategic direction of the Company and drives our commitment to foster a global spirit of hospitality and responsible tourism. |

| |

The Board will continue to review our Board leadership structure as part of the succession planning process. We believe that our leadership structure, in which the roles of Chairman and CEO are held by separate individuals, together with an experienced and engaged Lead Director and independent key Committees, is the optimal structure for our Company and our shareholders at this time.

Committees of the Board

The Board has four standing Committees: Audit, Compensation, Corporate Governance and Executive. The key responsibilities of each Committee, together with current membership and the number of meetings held in 2024, are set forth below.

| | | | | | | | |

| Audit Committee |

| | |

| | |

Chair Ronald L. Rickles Members Louise F. Brady George Herrera Michael H. Wargotz Meetings in 2024: 12 | | Key Responsibilities: •Appointing our independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and internal control over financial reporting. •Pre-approving all services performed by our independent registered public accounting firm. •Providing oversight on the external reporting process and the adequacy of our internal controls. •Reviewing the scope, planning, staffing and budgets of the audit activities of the independent registered public accounting firm and our internal auditors. •Reviewing services provided by our independent registered public accounting firm and other disclosed relationships as they bear on the independence of our independent registered public accounting firm, and providing oversight on hiring policies with respect to employees or former employees of the independent auditor. •Providing oversight of our enterprise risk management (ERM) process, including of the management of risks arising from cybersecurity threats. •Maintaining procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls and auditing matters. •Reviewing and updating periodically our Code of Conduct to promote ethical behavior by all of our associates. •Review and provide oversight of related person transactions in compliance with the Company’s Related Person Transactions Policy. |

| |

| |

| Financial Expertise, Independence, and Financial Literacy All members of the Audit Committee are independent under the Board’s Director Independence Criteria and applicable regulatory and listing standards, as well as financially literate, knowledgeable and qualified to review financial statements in accordance with applicable regulatory and listing standards. Ronald L. Rickles, Louise F. Brady and Michael H. Wargotz are audit committee financial experts within the meaning of applicable SEC rules and have “accounting or related financial management expertise” within the meaning of applicable NYSE rules. |

| | |

| | | | | | | | |

| Compensation Committee |

| | |

| | |

Chair Louise F. Brady Members James Buckman Denny Marie Post Michael H. Wargotz Meetings in 2024: 5 | | Key Responsibilities: •Providing oversight on our executive compensation program consistent with corporate objectives and shareholder interests. •Reviewing and approving Chief Executive Officer (CEO) and other senior management compensation. •Reviewing and considering the independence of advisers to the Compensation Committee. •Approving grants of long-term incentive awards and our senior executives’ annual incentive compensation under our compensation plans. •Periodically reviewing management succession planning and development. •Periodically reviewing our human capital programs, policies and procedures (except to the extent within the purview of the Corporate Governance Committee). |

| |

| |