Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | |

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

|

| | | | | |

Wyndham Destinations, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1 | ) | | Title of each class of securities to which transaction applies: |

| | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | (5 | ) | | Total fee paid: |

o | | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1 | ) | | Amount Previously Paid: |

| | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | (3 | ) | | Filing Party: |

| | (4 | ) | | Date Filed: |

NOTICE OF 2019 ANNUAL MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT

Wyndham Destinations, Inc.

6277 Sea Harbor Drive

Orlando, FL 32821

April 4, 2019

Dear Fellow Shareholders:

Our Board of Directors thanks you for the trust you have placed in us to act as stewards of your company. We are honored to lead a company that is committed to serving your best interests.

Our Board is made up of diverse, talented and committed individuals who bring both organizational knowledge and a broad range of perspectives and experiences. Upon consummation of the spin-off of our hotel business, we retained several members of the former Wyndham Worldwide board who bring extensive industry experience and invaluable guidance to our leadership team. Our CEO Michael D. Brown, Denny Marie Post and Ronald L. Rickles joined the Board. Ms. Post currently serves as the Chief Executive Officer of Red Robin. Mr. Rickles has over 30 years of senior finance and audit experience with Deloitte & Touche. Our Board is strong and is committed to delivering exceptional shareholder value to you.

UNLOCKING SHAREHOLDER VALUE

Last year was an extraordinary year for our company. At this time in 2018, we had announced plans to spin off the Wyndham Hotel Group into an independent public company. We completed the spin-off on May 31, 2018, thereby creating the world’s largest, publicly-traded company focused exclusively on vacation ownership and exchange. We are proud to say that in less than one year we have accomplished our strategic objectives, executed our plans without interruption, and are poised to deliver strong value to our shareholders.

DELIVERING CONTINUED GROWTH

Since completion of our spin-off, we have continued our strong track record of growth. In 2018, net revenues increased 3% to $3.9 billion. Due in large part to favorable tax adjustments in 2017, income from continuing operations in 2018 decreased 59% to $266 million and diluted EPS from continuing operations decreased 57% to $2.68. However, the Company delivered continued growth in overall net revenues, vacation ownership sales, and further adjusted EBITDA.*

The Company remains the leader in both vacation ownership and vacation exchange with $2.3 billion in gross vacation ownership interest (VOI) sales* and nearly $1 billion in exchange and rentals revenues. We delivered a 6% increase in gross VOI sales through a 2% increase in volume per guest (VPG) and a 4% increase in tours. In 2018, we delivered further adjusted EBITDA* of $957 million, an increase of 5% from the prior year. We reported further adjusted diluted earnings per share*of $4.84, which represented an increase of 13% from 2017.

Since the spin-off of Wyndham Hotels, we repurchased $221 million of stock through the end of 2018, which represented 5% of the shares that were outstanding as of June 1, 2018, the first day of trading post spin-off. Following the spin-off in 2018, we also returned $124 million in the form of dividends.

_____________

* Please see appendices to the proxy statement for cautionary language regarding forward-looking statements and reconciliation of our non-GAAP financial measures.

CREATING A NEW INDUSTRY LEADER

The creation of Wyndham Destinations, Inc. launched an exciting new brand into the hospitality industry. Our mission is to put the world on vacation. Our 25,000 associates around the world have refocused around four Strategic Pillars:

| |

• | Best in Class Sales and Marketing |

| |

• | Leading Brands and Offerings; and |

These four Strategic Pillars affirm our customer dominant focus, while also reflecting our relentless drive for superior sales and marketing, exceptional brands and products, and a commitment to operate all areas of the business with excellence.

INVESTING IN GROWTH

The spin-off allows Wyndham Destinations, Inc. to focus on our vacation ownership and exchange businesses. While we continue to retain an important partnership with the hotel business through our “Blue Thread” initiatives with the Wyndham Rewards program, we now focus our efforts and capital investments in areas that will deliver future growth for our shareholders and a better experience for our customers.

We have responded to our owners’ and market sentiment by opening new vacation club resorts in burgeoning regions and cities where we have opportunities to grow our owner base. In 2018, we opened new sales offices and new or expanded resort destinations in Austin, Texas, South Myrtle Beach, South Carolina and St. George, Utah. We also announced proposed new or expanded locations in Moab, Utah, Nashville, Tennessee, Portland, Oregon and Scottsdale, Arizona.

In addition, we are investing in next-generation digital platforms to provide enhanced connectivity to our current and future owners. These investments in new technology will allow us to increase sales and owner satisfaction by allowing owners to seamlessly engage with our sales teams and manage their vacation experiences.

DELIVERING RESULTS

Our 2018 performance continued to be recognized in the business world. The Wall Street Journal named us to its list of Top 250 managed companies who excel at serving their workers, customers and shareholders, based on a ranking by the Drucker Institute. In addition, Forbes magazine named us among the “Best Employers for New Grads” and “Best Employers for Diversity.”

Our business is about people. Our mission is achieved when our current and future owners, exchange members and rental guests are having the greatest vacation experiences of their lives in our amazing destinations around the world. Our 25,000 associates dedicate themselves every day to helping put the world on vacation. We recognize their tireless commitment and strive to provide a productive and diverse work environment which encourages excellence.

We appreciate the opportunity to provide you with our 2018 highlights and encourage you to read the proxy statement carefully for more information. You are cordially invited to attend the 2019 Annual Meeting of Shareholders to be held on Thursday, May 16, 2019. The meeting will start at 11:30 a.m. local time at the Wyndham Destinations offices located at 6277 Sea Harbor Drive in Orlando, Florida. Your vote is very important. Whether or not you plan to attend the 2019 Annual Meeting, please cast your vote as soon as possible. We look forward to continuing our dialogue in the future and we, along with our outstanding executive team and 25,000 associates worldwide, remain committed to creating even greater shareholder value for you.

Sincerely,

Stephen P. Holmes

Non-Executive Chairman of the Board

Michael D. Brown

President and Chief Executive Officer

WYNDHAM DESTINATIONS, INC.

NOTICE OF 2019 ANNUAL MEETING OF SHAREHOLDERS

April 4, 2019

|

| | |

Date: | | Thursday, May 16, 2019 |

Time: | | 11:30 a.m. Eastern Daylight Time |

Place: | | Wyndham Destinations, Inc. 6277 Sea Harbor Drive

Orlando, Florida 32821 |

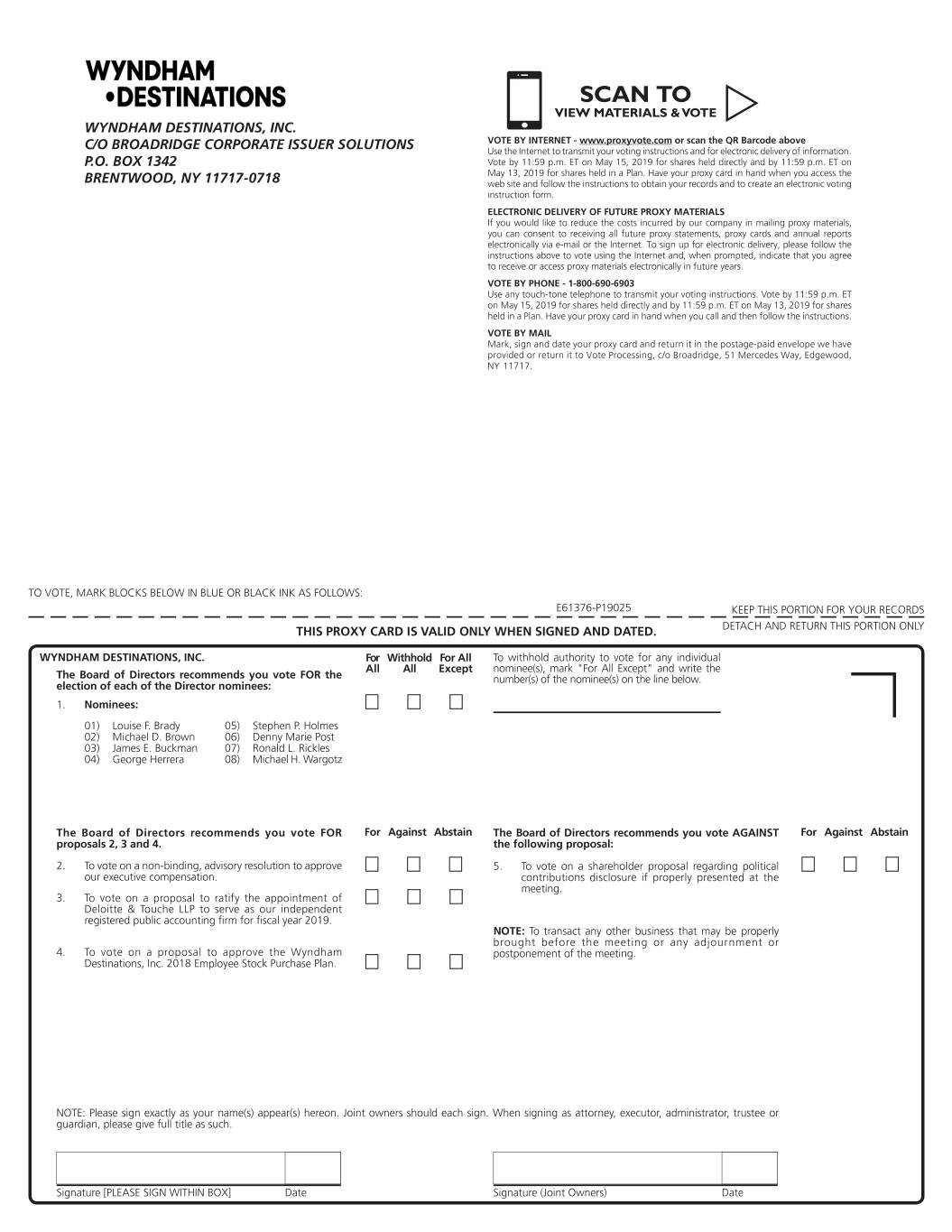

Purposes of the meeting:

| |

• | to elect eight Directors for a term expiring at the 2020 annual meeting. |

| |

• | to vote on a non-binding, advisory resolution to approve executive compensation. |

| |

• | to vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2019. |

| |

• | to vote on a proposal to approve the Wyndham Destinations, Inc. 2018 Employee Stock Purchase Plan. |

| |

• | to vote on a shareholder proposal regarding political contributions disclosure if properly presented at the meeting. |

| |

• | to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting. |

The matters specified for voting above are more fully described in the attached proxy statement. Only our shareholders of record at the close of business on March 22, 2019 will be entitled to notice of and to vote at the meeting and any adjournments or postponements for which no new record date is set.

Who may attend the meeting:

Only shareholders, persons holding proxies from shareholders, invited representatives of the media and financial community and other guests of Wyndham Destinations, Inc. may attend the meeting.

What to bring:

All persons attending the meeting must bring photo identification such as a valid driver’s license or passport for purposes of personal identification and proof of ownership of your shares.

If your shares are held in the name of a broker, trust, bank or other nominee, you will also need to bring a proxy, letter or recent account statement from that broker, trust, bank or nominee that confirms that you are the beneficial owner of those shares.

Record Date:

March 22, 2019 is the record date for the meeting. This means that owners of Wyndham Destinations common stock at the close of business on that date are entitled to:

| |

• | receive notice of the meeting and |

| |

• | vote at the meeting and any adjournment or postponement of the meeting for which no new record date is set. |

Information About the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to all of our shareholders, we provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about April 4, 2019, we will begin mailing a Notice to all shareholders as of March 22, 2019, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Householding Information:

We have adopted a procedure approved by the Securities and Exchange Commission called householding. Under this procedure, shareholders of record who have the same address and last name and have not previously requested electronic delivery of proxy materials will receive a single envelope containing the Notices for all shareholders having that address. The Notice for each shareholder will include that shareholder’s unique control number needed to vote his or her shares. This procedure will reduce our printing costs and postage fees.

If you do not wish to participate in householding and prefer to receive your Notice in a separate envelope, please contact Broadridge Financial Solutions by calling their toll-free number at (866) 540-7095 or through Broadridge Financial Solutions, Attn.: Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

For those shareholders who have the same address and last name and who request to receive a printed copy of the proxy materials by mail, we will send only one copy of such materials to each address unless one or more of those shareholders notifies us, in the same manner described above, that they wish to receive a printed copy for each shareholder at that address.

Beneficial shareholders may request information about householding from their banks, brokers or other holders of record.

Proxy Voting:

Your vote is important. Please vote your proxy promptly so your shares are represented, even if you plan to attend the annual meeting. You may vote by Internet, by telephone, by requesting a printed copy of the proxy materials and using the enclosed proxy card or in person at the annual meeting.

Our proxy tabulator, Broadridge Financial Solutions, must receive any proxy that will not be delivered in person at the annual meeting by 11:59 p.m. Eastern Daylight Time on Wednesday, May 15, 2019.

By order of the Board of Directors,

James Savina

Corporate Secretary

TABLE OF CONTENTS

WYNDHAM DESTINATIONS, INC.

PROXY STATEMENT

The enclosed proxy materials are provided to you at the request of the Board of Directors of Wyndham Destinations, Inc. (Board) to encourage you to vote your shares at our 2019 annual meeting of shareholders. This proxy statement contains information on matters that will be presented at the meeting and is provided to assist you in voting your shares. References in this proxy statement to “we,” “us,” “our,” the “Company” and “Wyndham Destinations” refer to Wyndham Destinations, Inc. and our consolidated subsidiaries.

Our Board made these materials available to you over the Internet or, upon your request, mailed you printed versions of these materials in connection with our 2019 annual meeting. We will mail a Notice of Internet Availability of Proxy Materials (Notice) to our shareholders beginning on or about April 4, 2019 and will post our proxy materials on the website referenced in the Notice on that same date. We are, on behalf of our Board, soliciting your proxy to vote your shares at our 2019 annual meeting. We solicit proxies to give all shareholders of record an opportunity to vote on matters that will be presented at the annual meeting.

WYNDHAM WORLDWIDE SPIN-OFF

In May 2018, Wyndham Worldwide Corporation (Wyndham Worldwide), as we were formerly known, completed the spin-off of its Hotel Group business, which became a new, publicly-traded hotel franchising and hotel management company, Wyndham Hotels & Resorts, Inc. (Wyndham Hotels).

Our Vacation Ownership business combined with our Destination Network business has been renamed Wyndham Destinations, Inc. and our common stock began to trade on the New York Stock Exchange under the symbol “WYND.” The transaction was effected through a pro-rata distribution of Wyndham Hotels’ common stock to Wyndham Worldwide shareholders on May 31, 2018. The spin-off resulted in two separate, publicly-traded companies, each with increased strategic flexibility and enhanced ability to focus on its core business and growth opportunities, facilitate capital raising and respond to developments in each respective market.

In connection with the spin-off, there were certain changes in our leadership. Stephen P. Holmes, our former Chief Executive Officer (CEO), resigned from that position and became the Non-Executive Chairman of our Board. Effective upon the completion of the spin-off, Michael D. Brown, the former President and CEO of our Vacation Ownership business, was appointed as our President and CEO and as a member of our Board. In addition, Myra J. Biblowit, The Right Honourable Brian Mulroney and Pauline D.E. Richards resigned from our Board effective upon the completion of the spin-off and joined the board of directors of Wyndham Hotels. Louise F. Brady, James E. Buckman, George Herrera and Michael H. Wargotz remain on our Board, with the addition of our two new Directors, Denny Marie Post and Ronald L. Rickles, who joined our Board upon the completion of the spin-off.

Our corporate governance and compensation programs, including certain changes in connection with the spin-off, are discussed in greater detail in this proxy statement.

FREQUENTLY ASKED QUESTIONS

When and where will the annual meeting be held?

The annual meeting will be held on Thursday, May 16, 2019 at 11:30 a.m. Eastern Daylight Time at Wyndham Destinations, Inc., 6277 Sea Harbor Drive, Orlando, Florida 32821.

What am I being asked to vote on at the meeting?

You are being asked to vote on the following:

| |

• | the election of eight Directors for a one-year term. |

| |

• | a non-binding, advisory resolution to approve our executive compensation program. |

| |

• | the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2019. |

| |

• | the approval of the Wyndham Destinations, Inc. 2018 Employee Stock Purchase Plan. |

| |

• | a shareholder proposal regarding political contributions disclosure if properly presented at the meeting. |

| |

• | to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting. |

We are not aware of any other matters that will be brought before the shareholders for a vote at the annual meeting. If any other matters are properly presented for a vote the individuals named as proxies will have discretionary authority to the extent permitted by law to vote on such matters according to their best judgment.

Who may vote and how many votes does a shareholder have?

All holders of record of our common stock as of the close of business on March 22, 2019 (record date) are entitled to vote at the meeting. Each shareholder will have one vote for each share of our common stock held as of the close of business on the record date. As of the record date, 93,702,201 shares of our common stock were outstanding. There is no cumulative voting and the holders of our common stock vote together as a single class.

How many votes must be present to hold the meeting?

The holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting, or 46,851,101 shares, must be present in person or by proxy at the meeting in order to constitute the quorum necessary to conduct the meeting. Abstentions and broker non-votes will be counted for the purposes of establishing a quorum at the meeting.

A broker non-vote occurs when a broker or other nominee submits a proxy that states that the broker does not vote for some or all of the proposals because the broker has not received instructions from the beneficial owner on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

How do I vote?

Even if you plan to attend the meeting you are encouraged to vote by proxy.

If you are a shareholder of record, also known as a registered shareholder, you may vote in one of the following ways:

| |

• | by telephone by calling the toll-free number (800) 690-6903 (have your Notice or proxy card in hand when you call); |

| |

• | by Internet at http://www.proxyvote.com (have your Notice or proxy card in hand when you access the website); |

| |

• | if you received (or requested and received) a printed copy of the proxy materials, by returning the enclosed proxy card (signed and dated) in the envelope provided; or |

| |

• | in person at the annual meeting (please see below under “How do I attend the meeting?”). |

If your shares are registered in the name of a bank, broker or other nominee, follow the proxy instructions on the form you receive from the bank, broker or other nominee. You may also vote in person at the annual meeting – please see below under “How do I attend the meeting?”

When you vote by proxy your shares will be voted according to your instructions. If you sign your proxy card or vote by Internet or by telephone but do not specify how you want your shares to be voted they will be voted as the Board recommends.

What if I am a participant in the Wyndham Destinations, Inc. Employee Savings Plan?

For participants in the Wyndham Destinations, Inc. Employee Savings Plan with shares of our common stock credited to their accounts, voting instructions for the trustees of the plan are also being solicited through this proxy statement. In accordance with the provisions of the plan the trustee will vote shares of our common stock in accordance with instructions received from the participants to whose accounts the shares are credited. If you do not instruct the plan trustee on how to vote the shares of our

common stock credited to your account, the trustee will vote those shares in the same proportion to the shares for which instructions are received.

How does the Board recommend that I vote?

The Board recommends the following votes:

| |

• | FOR the election of each of the Director nominees. |

| |

• | FOR the non-binding, advisory resolution to approve our executive compensation program. |

| |

• | FOR the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2019. |

| |

• | FOR the approval of the Wyndham Destinations, Inc. 2018 Employee Stock Purchase Plan. |

| |

• | AGAINST the shareholder proposal regarding political contributions disclosure. |

How many votes are required to approve each proposal?

In the election of Directors the affirmative vote of a plurality of the votes present in person or by proxy and entitled to vote at the meeting is required. This means the Director nominees receiving the greatest number of votes will be elected and abstentions and broker non-votes will have no effect on the outcome of the vote. However, as further described under “Election of Directors”, under the Board’s Corporate Governance Guidelines any nominee for Director who receives a greater number of votes withheld than votes for election is required to tender his or her resignation for consideration by the Corporate Governance Committee.

For all other proposals, the affirmative vote of the holders of a majority of the shares represented at the meeting in person or by proxy and entitled to vote on the proposal will be required for approval. Abstentions will have the effect of a vote against any of these proposals. Broker non-votes will have no effect on the outcome of these proposals.

If your shares are registered in the name of a bank, broker or other financial institution and you do not give your broker or other nominee specific voting instructions for your shares, under rules of the New York Stock Exchange, your record holder has discretion to vote your shares on the ratification of auditor proposal but does not have discretion to vote your shares on any of the other proposals. Your broker, bank or other financial institution will not be permitted to vote on your behalf on the election of Director nominees, the non-binding, advisory vote on executive compensation, the approval of the 2018 Employee Stock Purchase Plan or the shareholder proposal regarding political contributions disclosure unless you provide specific instructions before the date of the annual meeting by completing and returning the voting instruction or proxy card or following the instructions provided to you to vote your shares by telephone or the Internet.

How do I attend the meeting?

You must bring with you a photo identification such as a valid driver’s license or passport for personal identification and proof of ownership of your shares. If your shares are held in the name of a broker, trust, bank or other nominee, you will also need to bring a proxy, letter or recent account statement from that broker, trust, bank or nominee that confirms that you are the beneficial owner of those shares.

Can I change or revoke my vote?

You may change or revoke your proxy at any time prior to voting at the meeting by submitting a later dated proxy, by entering new instructions by Internet or telephone, by giving timely written notice of such change or revocation to the Corporate Secretary or by attending the meeting and voting in person and requesting that your prior proxy not be used.

How are proxies solicited?

We retained Georgeson to advise and assist us in soliciting proxies at a cost of $8,500 plus reasonable expenses. Proxies may also be solicited by our Directors, officers and employees personally, by mail, telephone or other electronic means for no additional compensation. We will pay all costs relating to the solicitation of proxies. We will also reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses in forwarding proxy materials to beneficial owners of our common stock.

How do I make a shareholder proposal for the 2020 meeting?

Shareholders interested in presenting a proposal for inclusion in our proxy statement and proxy relating to our 2020 annual meeting may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (Exchange Act). To be eligible for inclusion in next year’s proxy statement, shareholder proposals must be received by the Corporate Secretary at our principal executive offices no later than the close of business on December 6, 2019.

In general, any shareholder proposal to be considered at next year’s annual meeting but not included in the proxy statement must be submitted in accordance with the procedures set forth in our By-Laws. Notice of any such proposal must be submitted in writing to and received by the Corporate Secretary at our principal executive offices not earlier than January 17, 2020 and not later than February 16, 2020. However, if the date of the 2020 annual meeting is not within 30 days before or after May 16, 2020 then a shareholder will be able to submit a proposal for consideration at the annual meeting not later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or such notice of the date of such annual meeting was mailed whichever occurs first. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. Any notification to bring any proposal before an annual meeting must comply with the requirements of our By-Laws as to proper form. A shareholder may obtain a copy of our By-Laws on our website, www.wyndhamdestinations.com under the Investors page, which can be reached by clicking on the Governance link followed by the Governance Documents link, or by writing to our Corporate Secretary at Wyndham Destinations, Inc. 6277 Sea Harbor Drive, Orlando, Florida 32821.

Shareholders may also nominate directors for election at an annual meeting. To nominate a Director shareholders must comply with provisions of applicable law and our By-Laws. The Corporate Governance Committee will also consider shareholder recommendations for candidates to the Board sent to the Committee c/o the Corporate Secretary. See below under “Director Nomination Process” for information regarding nomination or recommendation of a Director.

GOVERNANCE OF THE COMPANY

Strong corporate governance is an integral part of our core values. Our Board is committed to having sound corporate governance principles and practices. Please visit our website at www.wyndhamdestinations.com under the Investors page, which can be reached by clicking on the Investor Relations link followed by the Governance link and looking under Governance Documents for the Board’s Corporate Governance Guidelines and Director Independence Criteria, the Board-approved charters for the Audit, Compensation and Corporate Governance Committees and related information. These guidelines and charters may also be obtained by writing to our Corporate Secretary at Wyndham Destinations, Inc., 6277 Sea Harbor Drive, Orlando, Florida 32821.

Corporate Governance Guidelines

Our Board adopted Corporate Governance Guidelines that along with the charters of the Board Committees, Director Independence Criteria and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. The governance rules for companies listed on the New York Stock Exchange and those contained in the Securities and Exchange Commission (SEC) rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically. The Corporate Governance Guidelines are available on the Investors page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

Director Independence Criteria

The Board adopted the Director Independence Criteria set out below for its evaluation of the materiality of Director relationships with us. The Director Independence Criteria contain independence standards that exceed the independence standards specified in the listing standards of the New York Stock Exchange. The Director Independence Criteria are available on the Investors page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

A Director who satisfies all of the following criteria shall be presumed to be independent under our Director Independence Criteria:

| |

• | Wyndham Destinations does not currently employ and has not within the last three years employed the Director or any of his or her immediate family members (except in the case of immediate family members, in a non-executive officer capacity). |

| |

• | The Director is not currently and has not within the last three years been employed by Wyndham Destinations’ present auditors nor has any of his or her immediate family members been so employed (except in a non-professional capacity not involving Wyndham Destinations business). |

| |

• | Neither the Director nor any of his or her immediate family members is or has been within the last three years part of an interlocking directorate in which an executive officer of Wyndham Destinations serves on the compensation or equivalent committee of another company that employs the Director or his or her immediate family member as an executive officer. |

| |

• | The Director is not a current employee nor is an immediate family member a current executive officer of a company that has made payments to or received payments from Wyndham Destinations for property or services in an amount in any of the last three fiscal years exceeding the greater of $750,000 or 1% of such other company’s consolidated gross revenues. |

| |

• | The Director currently does not have or has not had within the past three years a personal services contract with Wyndham Destinations or its executive officers. |

| |

• | The Director has not received and the Director’s immediate family member has not received during any twelve-month period within the last three years more than $100,000 in direct compensation from Wyndham Destinations other than Board fees. |

| |

• | The Director is not currently an officer or director of a foundation, university or other non-profit organization to which Wyndham Destinations within the last three years gave directly or indirectly through the provision of services more than the greater of 1% of the consolidated gross revenues of such organization during any single fiscal year or $100,000. |

Guidelines for Determining Director Independence

Our Corporate Governance Guidelines and Director Independence Criteria provide for director independence standards that meet or exceed those of the New York Stock Exchange. Our Board is required under New York Stock Exchange rules to affirmatively determine that each independent Director has no material relationship with Wyndham Destinations other than as a Director.

In accordance with these standards and criteria, the Board undertook its annual review of the independence of its Directors. During this review the Board considered whether there are any relationships or related party transactions between each Director, any member of his or her immediate family or other affiliated entities and us and our subsidiaries and affiliates. The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the Director is independent.

The Board follows a number of procedures to review related party transactions. We maintain a written policy governing related party transactions that requires Board approval of related party transactions exceeding $120,000. Each Board member answers a questionnaire designed to disclose conflicts and related party transactions. We also review our internal records for related party transactions. Based on a review of these standards and materials, none of our independent Directors had or has any relationship with us other than as a Director.

As a result of its review the Board affirmatively determined that the following Directors are independent of us and our management as required by the New York Stock Exchange listing standards and the Director Independence Criteria: Louise F. Brady, James E. Buckman, George Herrera, Denny Marie Post, Ronald L. Rickles and Michael H. Wargotz. All members of the Audit, Compensation and Corporate Governance Committees are independent Directors under the New York Stock Exchange listing standards, SEC rules and the Director Independence Criteria. The Board had also determined that each of The Right Honourable Brian Mulroney, Myra J. Biblowit and Pauline D.E. Richards, who served as Directors for a portion of 2018, was independent under the New York Stock Exchange listing standards, SEC rules and the Director Independence Criteria during the portion of 2018 he or she served as a director of the Company. See above under “Wyndham Worldwide Spin-Off,” for additional information on the departure of each of Mr. Mulroney and Mses. Biblowit and Richards from the Board in connection with the spin-off transaction.

Committees of the Board

The following describes our Board Committees and related matters. The composition of the Committees is provided immediately after.

Audit Committee

Responsibilities include:

| |

• | Appoints our independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and internal control over financial reporting. |

| |

• | Pre-approves all services performed by our independent registered public accounting firm. |

| |

• | Provides oversight on the external reporting process and the adequacy of our internal controls. |

| |

• | Reviews the scope, planning, staffing and budgets of the audit activities of the independent registered public accounting firm and our internal auditors. |

| |

• | Reviews services provided by our independent registered public accounting firm and other disclosed relationships as they bear on the independence of our independent registered public accounting firm and provides oversight on hiring policies with respect to employees or former employees of the independent auditor. |

| |

• | Maintains procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls and auditing matters. |

All members of the Audit Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards. The Board in its business judgment determined that each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements in accordance with applicable listing standards. The Board also determined that both Ronald L. Rickles and Michael H. Wargotz are audit committee financial experts within the meaning of applicable SEC rules.

The Audit Committee Charter is available on the Investor Relations page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

Audit Committee Report

The Audit Committee of the Board of Directors assists the Board in fulfilling its oversight responsibilities for the external financial reporting process and the adequacy of Wyndham Destinations’ internal controls. Specific responsibilities of the Audit Committee are set forth in the Audit Committee Charter adopted by the Board. The Charter is available on the Investors page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

The Audit Committee is comprised of four Directors, all of whom meet the standards of independence adopted by the New York Stock Exchange and the SEC. The Audit Committee appoints, compensates and oversees the services performed by Wyndham Destinations’ independent registered public accounting firm. The Audit Committee approves in advance all services to be performed by Wyndham Destinations’ independent registered public accounting firm in accordance with SEC rules and the Audit Committee’s established policy for pre-approval of all audit services and permissible non-audit services, subject to the de minimis exceptions for non-audit services.

Management is responsible for Wyndham Destinations’ financial reporting process including our system of internal controls and for the preparation of consolidated financial statements in compliance with generally accepted accounting principles, applicable laws and regulations. In addition, management is responsible for establishing, maintaining and assessing the effectiveness of Wyndham Destinations’ internal control over financial reporting. Deloitte & Touche LLP (Deloitte), Wyndham Destinations’ independent registered public accounting firm, is responsible for expressing an opinion on Wyndham Destinations’ consolidated financial statements and the effectiveness of Wyndham Destinations’ internal control over financial reporting. The Audit Committee reviewed and discussed Wyndham Destinations’ 2018 Annual Report on Form 10-K, including the audited consolidated financial statements of Wyndham Destinations for the year ended December 31, 2018, with management and Deloitte. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee also discussed with Deloitte matters required to be discussed by applicable standards and rules of the Public Company Accounting Oversight Board (PCAOB) and the SEC. The Audit Committee also received the written disclosures and the letter from Deloitte required by applicable standards and rules of the PCAOB including those required by Auditing Standard No. 1301, Communications with Audit Committees, and the SEC regarding Deloitte’s communications with the Audit Committee concerning independence, and discussed with Deloitte its independence.

The Audit Committee also considered whether the permissible non-audit services provided by Deloitte to Wyndham Destinations are compatible with Deloitte maintaining its independence. The Audit Committee satisfied itself as to the independence of Deloitte.

Based on the Audit Committee’s review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Wyndham Destinations’ Annual Report on Form 10-K for the year ended December 31, 2018.

AUDIT COMMITTEE

Michael H. Wargotz (Chair)

Louise F. Brady

George Herrera

Ronald L. Rickles

Compensation Committee

Responsibilities include:

| |

• | Provides oversight on our executive compensation program consistent with corporate objectives and shareholder interests. |

| |

• | Reviews and approves Chief Executive Officer (CEO) and other senior management compensation. |

| |

• | Approves grants of long-term incentive awards and our senior executives’ annual incentive compensation under our compensation plans. |

| |

• | Reviews and considers the independence of advisers to the Committee. |

For additional information regarding the Compensation Committee’s processes and procedures see below under “Executive Compensation – Compensation Discussion and Analysis – Compensation Committee Matters.”

All members of the Compensation Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards.

The Compensation Committee Report is provided below under Executive Compensation. The Compensation Committee Charter is available on the Investor Relations page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

Compensation Committee Interlocks and Insider Participation

During 2018, our Compensation Committee consisted of Mr. Mulroney and Mses. Biblowit and Richards and, in connection with the departure of Mr. Mulroney and Mses. Biblowit and Richards from the Board, Ms. Brady, Mr. Buckman, Ms. Post and Mr. Wargotz were appointed to the Compensation Committee on May 31, 2018. There are no compensation committee interlocks between Wyndham Destinations and other entities involving our executive officers and Directors.

Corporate Governance Committee

Responsibilities include:

| |

• | Recommends to the Board nominees for election to the Board. |

| |

• | Reviews principles, policies and procedures affecting Directors and the Board’s operation and effectiveness. |

| |

• | Provides oversight on the evaluation of the Board and its effectiveness. |

| |

• | Reviews and makes recommendations on Director compensation. |

All members of the Corporate Governance Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards.

The Corporate Governance Committee Charter is available on the Investor Relations’ page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link.

Executive Committee

The Executive Committee may exercise all of the authority of the Board when the Board is not in session, except that the Executive Committee does not have the authority to take any action which legally or under our internal governance policies may be taken only by the full Board.

Committee Membership

The following chart provides the current committee membership and the number of meetings that each committee held during 2018.

|

| | | | |

Director | Audit Committee | Compensation Committee | Governance Committee | Executive Committee |

Louise F. Brady | M | C | | |

Michael D. Brown | | | | M |

James E. Buckman | | M | | M |

George Herrera | M | | C | |

Stephen P. Holmes | | | | C |

Denny Marie Post | | M | M | |

Ronald L. Rickles | M | | M | |

Michael H. Wargotz | C | M | | M |

Number of Meetings in 2018 | 9 | 6 | 4 | 4 |

C = Chair

M = Member

The Board held nine meetings during 2018. During the course of 2018, (i) our Audit Committee consisted of Messrs. Wargotz and Herrera and Mses. Brady and Richards and, in connection with the departure of Ms. Richards from the Board, Mr. Rickles was appointed to the Audit Committee on May 31, 2018; (ii) our Compensation Committee consisted of Mr. Mulroney and Mses. Biblowit and Richards and, in connection with the departure of Mr. Mulroney and Mses. Biblowit and Richards from the Board, Ms. Brady, Mr. Buckman, Ms. Post and Mr. Wargotz were appointed to the Compensation Committee on May, 31, 2018; (iii) our Corporate Governance Committee consisted of Messrs. Herrera and Mulroney and Mses. Biblowit and Brady and, in connection with the departure of Mr. Mulroney and Ms. Bilbowit from the Board, Ms. Brady resigned from the Corporate Governance Committee and Ms. Post and Mr. Rickles were appointed to the Corporate Governance Committee on May 31, 2018; and (iv) our Executive Committee consisted of Messrs. Buckman, Holmes and Wargotz and, in connection with the appointment of Mr. Brown to the Board, Mr. Brown was appointed to the Executive Committee on May 31, 2018. Each Director attended at least 75% of the meetings of the Board and the committees of the Board on which the Director served while in office. See above under “Wyndham Worldwide Spin-Off,” for additional information on the departure of each of Mr. Mulroney and Mses. Biblowit and Richards from the Board and the appointment of each of Messrs. Brown and Rickles and Ms. Post to the Board in connection with the spin-off transaction.

Directors fulfill their responsibilities not only by attending Board and committee meetings but also through communication with the Chairman, Lead Director, CEO and other members of management relative to matters of interest and concern to Wyndham Destinations.

Board Leadership Structure and Lead Director

As discussed above under “Wyndham Worldwide Spin-Off,” newly constituted boards for the Company and Wyndham Hotels were appointed in connection with the spin-off, each comprising certain members of the former Wyndham Worldwide board as well as new appointees.

While the Board has not mandated a particular leadership structure, historically, the positions of Chairman of the Board and CEO were held by the same person. In 2018, as a result of Mr. Holmes’ discussions with the Board about resigning as our CEO in connection with the spin-off and as part of its ongoing review of the Board leadership structure and succession planning process, the Board determined that at this time the positions of Chairman and CEO should be held by separate individuals. In connection with the spin-off, effective as of May 31, 2018, the Board elected Mr. Holmes, who had served as the Chairman and CEO of the Company since July 2006, to the position of Non-Executive Chairman of the Board. At the same time, the Board also appointed Mr. Brown, our new President and CEO, as a member of our Board.

In his new role, Mr. Holmes continues to provide leadership to the Board by, among other things, working with the CEO, the Lead Director, and the Corporate Secretary to set Board calendars, determine agendas for Board meetings, ensure proper flow of information to Board members, facilitate effective operation of the Board and its committees, help promote Board succession planning and the orientation of new Directors, address issues of Director performance, assist in consideration and Board adoption of the Company’s long-term and annual operating plans, and help promote senior management succession planning. Mr. Holmes’

experience as our former CEO and his knowledge and familiarity with our business and industry bring valuable perspective to the Board. In addition, Mr. Brown’s service as a Director promotes strategy development and execution and facilitates information flow between management and the Board, which is also essential to effective governance.

The Board also recognizes the importance of having independent Board leadership and selected James E. Buckman, an independent Director who serves as a member of the Executive Committee, to serve as the Board’s Lead Director. The Lead Director serves as a key advisor to our Chairman, chairs executive sessions of independent Directors and provides feedback to the Chairman, chairs meetings of the Board in the absence of the Chairman, and reviews in advance, and as appropriate, consults with the Chairman regarding, the agendas for all Board and committee meetings.

Six of our eight current directors are independent, and the Audit, Compensation and Corporate Governance Committees are comprised solely of independent directors. Consequently, the independent Directors directly oversee such critical items as the Company’s financial statements, executive compensation, the selection and evaluation of directors and the development and implementation of our corporate governance programs. Our independent directors, led by our Lead Director, bring experience, oversight and expertise from outside our Company and industry, which balances the Company-specific experience and expertise that our Non-Executive Chairman and CEO bring to the Board.

The Board will continue to review our Board leadership structure as part of the succession planning process. We believe that our leadership structure, in which the roles of Chairman and CEO are held by separate individuals, together with an experienced and engaged Lead Director and independent key committees, is the optimal structure for our Company and our shareholders at this time.

Oversight of Risk Management

The Board has an active role, as a whole and at the committee level, in providing oversight with respect to management of our risks. The Board focuses on the most significant risks facing us and our general risk management strategy and seeks to ensure that risks undertaken by us are consistent with a level of risk that is appropriate for our company and aligned with the achievement of our business objectives and strategies.

The Board regularly reviews information regarding risks associated with our finances, credit and liquidity; our business, operations and strategy; legal, regulatory and compliance matters; and reputational exposure. The Audit Committee provides oversight on our programs for risk assessment and risk management, including with respect to financial accounting and reporting, internal audit, information technology, cybersecurity and compliance. With respect to cybersecurity risk oversight, our Audit Committee receives periodic updates from the appropriate managers on the primary cybersecurity risks facing the Company and the measures the Company is taking to mitigate such risks. In addition to such periodic reports, our Audit Committee receives updates from management regarding any changes to the Company’s cybersecurity risk profile or significant newly identified risks. The Compensation Committee provides oversight on our assessment and management of risks relating to our executive compensation. The Corporate Governance Committee provides oversight on our management of risks associated with the independence of the Board and potential conflicts of interest. While each committee is responsible for providing oversight with respect to the management of risks, the entire Board is regularly informed about our risks through committee reports and management presentations.

While the Board and the committees provide oversight with respect to our risk management, our CEO and other senior management are primarily responsible for day-to-day risk management analysis and mitigation and report to the full Board or the relevant committee regarding risk management. Our leadership structure, with Mr. Holmes serving as our Non-Executive Chairman and with Mr. Brown serving as a Director, also enhances the Board’s effectiveness in risk oversight due to the extensive knowledge of Mr. Holmes and Mr. Brown with respect to our business and operations, facilitating the Board’s oversight of key risks. We believe this division of responsibility and leadership structure is the most effective approach for addressing our risk management.

Executive Sessions of Non-Management Directors and Independent Directors

The Board meets regularly without any members of management present. In addition, at least once a year, the independent Directors meet in a private session that excludes management and non-independent directors. The Lead Director chairs these sessions.

Communications with the Board and Directors

Shareholders and other parties interested in communicating directly with the Board, an individual non-management or independent Director or the non-management or independent Directors as a group may do so by writing our Corporate Secretary at Wyndham Destinations, Inc., 6277 Sea Harbor Drive, Orlando, Florida. The Corporate Secretary will forward the correspondence only to

the intended recipients. However, prior to forwarding any correspondence, the Corporate Secretary will review it and in his discretion will not forward correspondence deemed to be of a commercial nature or otherwise not appropriate for review by the Directors.

Director Attendance at Annual Meeting of Shareholders

As provided in the Board’s Corporate Governance Guidelines, Directors are expected to attend our annual meeting absent exceptional cause. All of our Directors at the time attended our 2018 annual meeting and all of our current Directors are expected to attend the 2019 annual meeting.

Code of Business Conduct and Ethics

The Board maintains a Code of Business Conduct and Ethics for Directors with ethics guidelines specifically applicable to Directors. In addition, we maintain a Code of Conduct applicable to all our associates, including our CEO, Chief Financial Officer (CFO) and Chief Accounting Officer.

We will disclose on our website any amendment to or waiver from a provision of our Code of Business Conduct and Ethics for Directors or Code of Conduct as may be required and within the time period specified under applicable SEC and New York Stock Exchange rules. The Code of Business Conduct and Ethics for Directors and our Code of Conduct are available on the Investor Relations page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link. Copies of these documents may also be obtained free of charge by writing to our Corporate Secretary.

Director Nomination Process

Role of Corporate Governance Committee. The Corporate Governance Committee is responsible for recommending the Director nominees for election to the Board. The Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board when considering potential candidates to serve on the Board. Nominees for Director are selected on the basis of their depth and breadth of experience, skills, wisdom, integrity, ability to make independent analytical inquiries, understanding of our business environment and willingness to devote adequate time to Board duties.

The Corporate Governance Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills.

The Corporate Governance Committee does not have a formal policy with respect to diversity, however, the Board and the Corporate Governance Committee believe that it is essential that the Board members represent diverse viewpoints. In considering candidates for the Board, the Corporate Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. For the nomination of continuing Directors for re-election, the Corporate Governance Committee also considers the individual’s contributions to the Board.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as senior executives of large organizations as well as extensive board experience. Certain individual qualifications, experience and skills of our Directors that led the Board to conclude that each nominee or Director should serve as our Director are described below under “Election of Directors.”

Identification and Evaluation Process. The process for identifying and evaluating nominees to the Board is initiated by identifying a candidate who meets the criteria for selection as a nominee and has the specific qualities or skills being sought based on input from members of the Board and, if the Corporate Governance Committee deems appropriate, a third-party search firm. These candidates will be evaluated by the Corporate Governance Committee by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. Qualified nominees will be interviewed by at least one member of the Corporate Governance Committee. Using the input from the interview and other information it obtains, the Corporate Governance Committee evaluates whether the prospective candidate is qualified to serve as a Director and whether the Corporate Governance Committee should recommend to the Board that the Board nominate the prospective candidate for election by the shareholders or to fill a vacancy on the Board. Ms. Post and Mr. Rickles were newly appointed by the Wyndham Destinations Board in June 2018 in connection with the spin-off. The Company worked with a third party search firm to assist in the identification, recruitment and evaluation of Ms. Post and Mr. Rickles.

Shareholder Recommendations of Nominees. The Corporate Governance Committee will consider written recommendations from shareholders for nominees for Director. Recommendations should be submitted to the Corporate Governance Committee, c/o the Corporate Secretary, and include at least the following: name of the shareholder and evidence of the person’s ownership

of our common stock, number of shares owned and the length of time of ownership, name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a Director and the person’s consent to be named as a Director if selected by the Corporate Governance Committee and nominated by the Board. To evaluate nominees for Directors recommended by shareholders, the Corporate Governance Committee intends to use a substantially similar evaluation process as described above.

Shareholder Nominations and By-Law Procedures. Our By-Laws establish procedures pursuant to which a shareholder may nominate a person for election to the Board. Our By-Laws are available on the Investor Relations’ page of our website at www.wyndhamdestinations.com by clicking on the Governance link followed by the Governance Documents link. To nominate a person for election to the Board, a shareholder must submit a notice containing all information required by our By-Laws regarding the Director nominee and the shareholder and any associated persons making the nomination, including name and address, number of shares owned, a description of any additional interests of such nominee or shareholder and certain representations regarding such nomination. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. We may require any proposed nominee to furnish such other information as we may require to determine his or her eligibility to serve as a Director. Such notice must be accompanied by the proposed nominee’s consent to being named as a nominee and to serve as a Director if elected.

To nominate a person for election to the Board at our 2020 annual meeting, written notice of a shareholder nomination must be delivered to our Corporate Secretary not earlier than January 17, 2020 and not later than February 16, 2020. However, if the date of the 2020 annual meeting is not within 30 days before or after May 16, 2020, then a shareholder’s written notice will be timely if it is delivered by no later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or the notice of the date of the annual meeting was mailed, whichever occurs first. Our By-Laws require that any such notice be updated as necessary as of specified dates prior to the annual meeting. A shareholder may make nominations of persons for election to the Board at a special meeting if the shareholder delivers written notice to our Corporate Secretary not later than the close of business on the 10th day following the day on which public disclosure of the date such special meeting was made or notice of such special meeting was mailed, whichever occurs first. At a special meeting of shareholders, only such business may be conducted as shall have been brought before the meeting under our notice of meeting.

Compensation of Directors

Non-management Directors receive compensation for Board service designed to compensate them for their Board responsibilities and align their interests with the interests of shareholders. A management Director receives no additional compensation for Board service.

In connection with the spin-off, effective as of May 31, 2018, the Board elected Stephen P. Holmes, who had served as the Chairman and CEO of the Company since July 2006, to the position of Non-Executive Chairman of the Board. In connection with his new position as Non-Executive Chairman of the Board, on June 1, 2018, the Company entered into a letter agreement with Mr. Holmes (Holmes Letter Agreement), which provides him with an annual retainer of $320,000 (with $160,000 payable in the form of cash and $160,000 payable in the form of Wyndham Destinations common stock), a subsidy of $18,750 per year toward his costs incurred in connection with retaining an administrative assistant, a subsidy of $12,500 per year toward his costs incurred in connection with securing office space, a contribution towards 50% of the cost of the lease associated with his vehicle, through the earlier of the conclusion of the lease term and the conclusion of his service, and reimbursement for 50% of the cost of his annual executive health and wellness physical.

Except for the Holmes Letter Agreement and the 2018 Director equity grants (described below), the Director compensation program for 2018 remained consistent with our 2017 program.

Annual Retainer Fees. The following table describes 2018 annual retainer and committee chair and membership fees for non-management Directors. Our Directors do not receive additional fees for attending Board or committee meetings.

|

| | | | | | | | | | | | |

| | Cash-Based | | Stock-Based | | Total |

Non-Executive Chairman | | $ | 160,000 |

| | $ | 160,000 |

| | $ | 320,000 |

|

Lead Director | | $ | 132,500 |

| | $ | 132,500 |

| | $ | 265,000 |

|

Director | | $ | 105,000 |

| | $ | 105,000 |

| | $ | 210,000 |

|

Audit Committee chair | | $ | 22,500 |

| | $ | 22,500 |

| | $ | 45,000 |

|

Audit Committee member | | $ | 12,500 |

| | $ | 12,500 |

| | $ | 25,000 |

|

Compensation Committee chair | | $ | 17,500 |

| | $ | 17,500 |

| | $ | 35,000 |

|

Compensation Committee member | | $ | 10,000 |

| | $ | 10,000 |

| | $ | 20,000 |

|

Corporate Governance Committee chair | | $ | 15,000 |

| | $ | 15,000 |

| | $ | 30,000 |

|

Corporate Governance Committee member | | $ | 8,750 |

| | $ | 8,750 |

| | $ | 17,500 |

|

Executive Committee member | | $ | 10,000 |

| | $ | 10,000 |

| | $ | 20,000 |

|

The annual Director retainer and committee chair and membership fees are paid on a quarterly basis 50% in cash and 50% in Wyndham Destinations stock. The requirement for Directors to receive at least 50% of their fees in our equity further aligns their interests with those of our shareholders. The number of shares of stock issued is based on our stock price on the quarterly determination date. Directors may elect to receive the stock-based portion of their fees in the form of common stock or deferred stock units (DSUs). Directors may also elect to defer any cash-based compensation or vested restricted stock units (RSUs) in the form of DSUs. A DSU entitles the Director to receive one share of common stock following the Director’s retirement or termination of service from the Board for any reason and is credited with dividend equivalents during the deferral period. The Director may not sell or receive value from any DSU prior to termination of service.

Director Equity Awards. In addition to the annual retainer fees, to further align our Directors’ interests with those of our shareholders, the 2018 compensation of our non-management Directors included the following grants: (i) on March 1, 2018, each of our non-management Directors then in office, as well as Mr. Holmes, received a $50,000 equity grant of time-vesting RSUs which vests on July 1, 2019, which date represents the first anniversary of the closing date of the spin-off transaction plus thirty days and (ii) on June 1, 2018, each of our non-management Directors received a $150,000 grant of time-vesting RSUs which vests ratably over a four-year period.

In November 2018, the Corporate Governance Committee determined that our non-management Directors will receive annual equity grants in 2019 in an amount consistent with our Director compensation program for 2017 and, on March 7, 2019, each of our non-management Directors then in office received a $100,000 annual equity grant of time-vesting RSUs which vest ratably over a four-year period. RSUs are credited with dividend equivalents subject to the same vesting restrictions as the underlying units.

Treatment of Outstanding Director Equity Awards Upon Completion of the Spin-Off. In connection with the spin-off, our non-management Directors continued to hold all of their RSUs and DSUs covering shares of Wyndham Worldwide stock (which became Wyndham Destinations stock following completion of the spin-off) and also received RSUs and DSUs covering an equal amount of shares of Wyndham Hotels stock in accordance with the spin-off distribution ratio. With respect to outstanding RSUs held by our non-management Directors in office at the completion of the spin-off:

| |

• | For Messrs. Buckman, Herrera and Wargotz and Ms. Brady, the RSUs covering Wyndham Destinations shares vested on November 30, 2018, which date is the six-month anniversary of the completion of the spin-off. The RSUs covering shares of Wyndham Hotels fully vested upon completion of the spin-off. |

| |

• | For Mses. Biblowit and Richards and Mr. Mulroney, the RSUs covering Wyndham Destinations shares fully vested upon completion of the spin-off. The RSUs covering shares of Wyndham Hotels vested on November 30, 2018, which date is the six-month anniversary of the completion of the spin-off. |

We provide up to a three-for-one company match of a non-management Director’s qualifying charitable contributions up to a company contribution of $75,000 per year.

We maintain a policy to award our non-management Directors annually 500,000 Wyndham Rewards Points. These Wyndham Rewards Points have an approximate value of $2,555 and may be redeemed for numerous rewards options including stays at

Wyndham properties. This benefit provides our Directors with ongoing, first-hand exposure to our properties and operations, furthering their understanding and evaluation of our businesses.

2018 Director Compensation Table

The following table describes compensation we paid our non-management Directors for 2018. Mr. Holmes, who served as the CEO of Wyndham Worldwide until the completion of the spin-off transaction in May 2018, is one of our named executive officers. For information regarding the fees he received as a non-employee Director following the spin-off, see the Summary Compensation Table and the accompanying All Other Compensation Table in this proxy statement.

|

| | | | | | | | |

Name | Fees Paid in Cash ($) | Stock Awards ($)(a)(b) | All Other Compensation ($)(c) | Total ($) |

Myra J. Biblowit(d) | __ |

| 173,567 |

| 34,580 |

| 208,147 |

|

Louise F. Brady | — |

| 461,236 |

| 77,555 |

| 538,791 |

|

James E. Buckman | 147,738 |

| 347,233 |

| 77,555 |

| 572,526 |

|

George Herrera | 132,637 |

| 332,276 |

| 31,280 |

| 496,193 |

|

The Right Honourable Brian Mulroney(e) | 65,718 |

| 115,494 |

| 39,508 |

| 220,720 |

|

Denny Marie Post(f) | 72,201 |

| 222,117 |

| 74,195 |

| 368,513 |

|

Pauline D.E. Richards(g) | 63,907 |

| 113,563 |

| 33,208 |

| 210,678 |

|

Ronald L. Rickles(h) | 73,650 |

| 223,607 |

| 66,254 |

| 363,511 |

|

Michael H. Wargotz | 142,749 |

| 342,248 |

| 78,532 |

| 563,529 |

|

_______________

| |

(a) | Represents the aggregate grant date fair value of stock awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (ASC718). On March 1, 2018, each non-management Director then in office (Mses. Biblowit, Brady and Richards and Messrs. Buckman, Herrera, Mulroney and Wargotz) was granted a time-vesting RSU award with a grant date fair value of $50,000 which vests on July 1, 2019. On June 1, 2018, each non-management Director then in office (Mses. Brady and Post and Messrs. Buckman, Herrera, Rickles and Wargotz) was granted a time-vesting RSU award with a grant date fair value of $150,000 which vests ratably over four years. The remaining amount in each row represents the aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs. |

| |

(b) | Total shares of our common stock issuable for DSUs at December 31, 2018 were as follows: Ms. Brady, 8,903; Mr. Buckman, 58,743; Mr. Herrera, 34,806; Ms. Post, 1,673; Mr. Rickles, 1,708; and Mr. Wargotz, 60,931. Total shares of our common stock issuable for unvested RSUs at December 31, 2018 were as follows: Ms. Brady, 3,511; Mr. Buckman, 3,511; Mr. Herrera, 3,511; Ms. Post, 3,079; Mr. Rickles, 3,079; and Mr. Wargotz, 3,511. In 2018, Mr. Mulroney and Mses. Biblowit and Richards resigned from our Board and all of the unvested RSUs covering Wyndham Destinations shares fully vested upon completion of the spin-off on May 31, 2018. |

| |

(c) | Includes amounts attributable to charitable matching contributions made on behalf of the Director, the value of Wyndham Rewards Points and life insurance premiums paid by us as applicable. The value of charitable matching contributions were as follows: Ms. Biblowit, $32,025; Ms. Brady, $75,000; Mr. Buckman, $75,000; Mr. Herrera, $28,725; Mr. Mulroney, $36,953; Ms. Post, $71,640; Ms. Richards, $28,725; Mr. Rickles, $63,699; and Mr. Wargotz, $73,350. All directors received 500,000 Wyndham Rewards Points with an approximate value of $2,555. Life insurance premiums paid by us under a legacy Wyndham Worldwide program were $1,928 for Ms. Richards and $2,627 for Mr. Wargotz. The value of dividends is factored into the grant date fair value of our stock awards. Accordingly, dividends paid are not reflected in the table above. |

| |

(d) | Ms. Biblowit served on our Board through her resignation, which was effective May 31, 2018. Her director retainer fee as well as her fees for service as a member of the Compensation Committee and the Corporate Governance Committee were pro-rated accordingly. The aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs was $123,623. There were no cash payments to her in 2018. |

| |

(e) | Mr. Mulroney served on our Board through his resignation, which was effective May 31, 2018. His director retainer fee as well as his fees for service as Chairman of the Compensation Committee and as a member of the Corporate Governance Committee were pro-rated accordingly. The aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs was $65,550. |

| |

(f) | Ms. Post was appointed to our Board on May 31, 2018. The aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs was $72,139. Her director retainer fee as well as her fees for service as a member of the Compensation Committee and the Corporate Governance Committee were pro-rated accordingly. |

| |

(g) | Ms. Richards served on our Board through her resignation, which was effective May 31, 2018. Her director retainer fee as well as her fees for service as a member of the Audit Committee and the Compensation Committee were pro-rated accordingly. The aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs was $63,620. |

| |

(h) | Mr. Rickles was appointed to our Board on May 31, 2018. His director retainer fee as well as his fees for service as a member of the Audit Committee and the Corporate Governance Committee were pro-rated accordingly. The aggregate grant date fair value of retainer fees paid in the form of common stock and/or DSUs was $73,629. |

Non-Management Director Stock Ownership Guidelines

The Corporate Governance Guidelines require each non-management Director to comply with Wyndham Destinations’ Non-Management Director Stock Ownership Guidelines. These guidelines require each non-management Director to beneficially own an amount of our stock equal to the greater of a multiple of at least five times the cash portion of the annual retainer or two and one-half times the total retainer value without regard to Board committee fees. Directors have a period of five years after joining the Board to achieve compliance with this ownership requirement. DSUs and RSUs credited to a Director count towards satisfaction of the guidelines. As of December 31, 2018, except for Ms. Post and Mr. Rickles who joined our Board in May 2018 and have until May 2023 to achieve compliance, all of our non-management Directors were in compliance with the stock ownership guidelines.

Ownership of Company Stock

The following table describes the beneficial ownership of our common stock for the following persons as of December 31, 2018: each executive officer named in the Summary Compensation Table below, each Director, each person who to our knowledge beneficially owns in excess of 5% of our common stock and all of our Directors and executive officers as a group. The percentages are based on 95,044,018 shares of our common stock outstanding as of December 31, 2018. The principal address for each Director and executive officer of Wyndham Destinations is 6277 Sea Harbor Drive, Orlando, Florida 32821.

|

| | | | | |

Name | Number of Shares | | % of Class |

|

Iridian Asset Management LLC | 10,805,639 |

| (a) | 11.37 | % |

BlackRock, Inc. | 9,193,085 |

| (b) | 9.67 | % |

The Vanguard Group | 8,780,062 |

| (c) | 9.24 | % |

Boston Partners | 7,045,445 |

| (d) | 7.41 | % |

Louise F. Brady | 8,903 |

| (e)(f) | * |

|

Michael D. Brown | 34,836 |

| (e)(f) | * |

|

James E. Buckman | 65,741 |

| (e)(f)(g) | * |

|

George Herrera | 34,806 |

| (e)(f) | * |

|

Stephen P. Holmes | 1,248,266 |

| (e)(f)(h) | 1.31 | % |

Michael A. Hug | 10,650 |

| (e) | * |

|

Gail Mandel | 16,000 |

| (i) | * |

|

Scott G. McLester | 53,554 |

| (i) | * |

|

Jeffrey Myers | 15,376 |

| (e) | * |

|

Denny Marie Post | 1,673 |

| (e)(f) | * |

|

Geoffrey Richards | 18,764 |

| (e) | * |

|

Ronald L. Rickles | 1,708 |

| (e)(f) | * |

|

James Savina | — |

| (e) | * |

|

Michael H. Wargotz | 61,653 |

| (e)(f) | * |

|

David B. Wyshner | 34,814 |

| (i) | * |

|

All Directors and executive officers as a group (16 persons) | 1,513,118 |

| (j) | 1.59 | % |

_______________

* Amount represents less than 1% of outstanding common stock.

| |

(a) | We have been informed by Amendment No. 1 to a report on Schedule 13G filed with the SEC on February 6, 2019 by Iridian Asset Management LLC and affiliates named in such report (Iridian) that Iridian beneficially owns 10,805,639 shares of our common stock with sole voting power over no shares, shared voting power over 10,805,639 shares, sole dispositive power over no shares and shared dispositive power over 10,805,639 shares. The principal business address for Iridian is 276 Post Road West, Westport, CT 06880-4704. |

| |

(b) | We have been informed by Amendment No. 6 to a report on Schedule 13G filed with the SEC on February 6, 2019 by BlackRock, Inc. and affiliates named in such report (BlackRock) that BlackRock beneficially owns 9,193,085 shares of our common stock with sole voting power over 8,690,590 shares, shared voting power over no shares, sole dispositive power over 9,193,085 shares and shared dispositive power over no shares. The principal business address for BlackRock is 55 East 52nd Street, New York, New York 10055. |

| |

(c) | We have been informed by Amendment No. 11 to a report on Schedule 13G filed with the SEC on February 11, 2019 by The Vanguard Group (TVG) that TVG beneficially owns 8,780,062 shares of our common stock with sole voting power over 52,696 shares, shared voting power over 13,200 shares, sole |

dispositive power over 8,722,343 shares and shared dispositive power over 57,719 shares. The principal business address for TVG is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355.

| |